Quick summary:

New survey is up & running - click here.

A week where the major tech earnings all under-performed, but the market was stubbornly moving higher

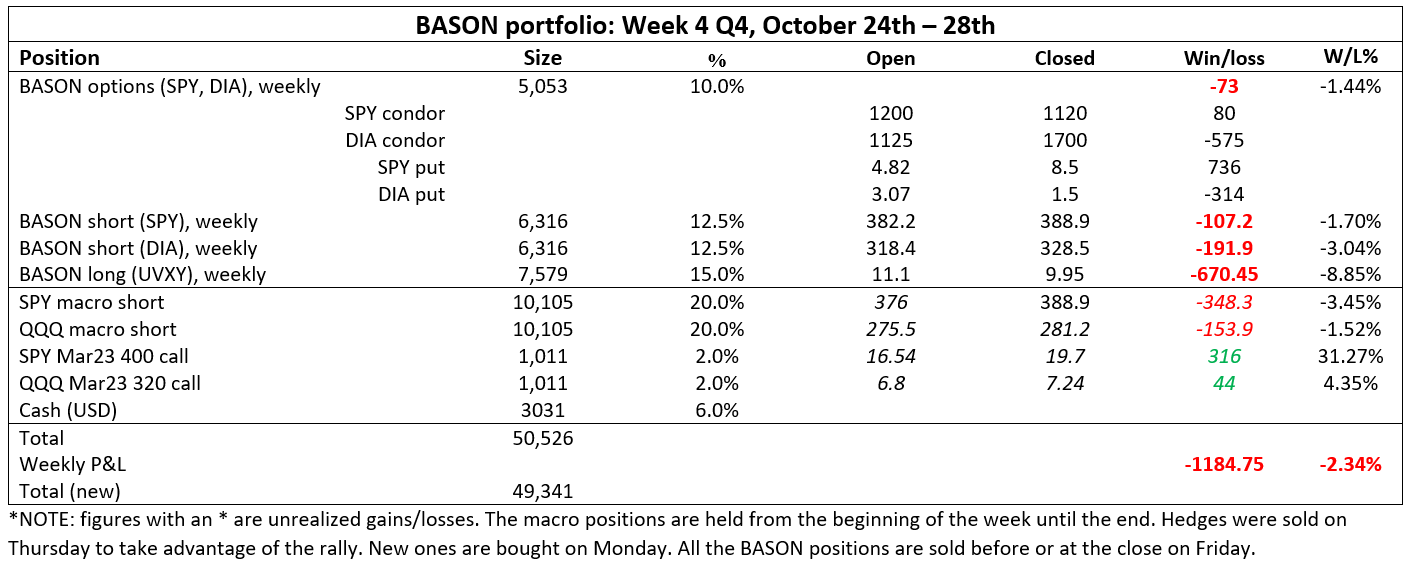

Portfolio was down 2% for the week, up 146% overall

FOMC meeting coming up on Wednesday!

Welcome back, dear subscribers. The Q4 competition is now open for its fifth week. The leaderboard is updated and available within the app. Remember, Q4 opened with a new competition and a $5,000 prize pot allocated to the first 10 users. It’s a whole new ballgame and we welcome your great contributions:

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance and portfolio update

Another strange week behind us. It started with Tuesday’s earnings miss of MSFT and GOOGL. Markets opened Wednesday down 1%, only to shoot up intraday (almost killing our options positions immediately), but still finishing the day lower. An almost identical scenario happened on Thursday following the earnings miss of META the day before: an initial up-move followed by a steady decline for the rest of the day.

And then the climax: Thursday post-market earnings from AMZN (another big miss, stock slumped -17% initially) send markets down 1.5% after-hours. Our SPY put position got filled at a 72% profit covering all our DIA losses from earlier that day. Friday’s futures moves were suggesting a clear move down, as SPY was trading at our target of 375 just a few hours before the open on Friday.

But then this happened:

On Friday the markets rallied and the SPX finished above 3900 (+2.5% for the day). APPL beat its earnings estimate, but this was hardly the only reason for the rally. The overall conditions simply favored an up move, very similar to what happened last Friday actually (when we got it spot on).

This time, unfortunately, we didn’t. The earnings miss of MSFT and GOOGL earlier in the week signaled strong bearishness. And until literally the open on Friday, we were spot on. Until we weren’t.

But hey, can’t win ‘em all!

The portfolio didn’t suffer too much, however. The closing of SPY puts for a profit on Thursday (reported immediately on Twitter) saved the options book and ensured that the overall loss was contained at 2.3%. The call hedges helped as well - which is their point after all.

The weekly return was -2.3%, bringing us back to under $50,000 overall (and +146% since the start). In terms of pure direction and precision, the performance was a clear miss across the board.

In times like these, drawdown control is crucial, which is exactly what we did.

5 out of 6 major components of SPX reported earnings misses for the past two weeks (first TSLA last week, and then MSFT, GOOGL, META, AMZN this week), but despite all this, markets kept rallying. Counter-intuitive? Maybe. But think of it in terms of a market signal. Despite earnings misses of the major SPX components, it still kept going up. That’s resilience. All the more interesting given that Wednesday is once again FOMC day, so expect more volatility.

Options: all positions stopped out

As mentioned last week, we opened the following options positions:

this week we're trading 370/371 to 385/386 SPY 28/10 iron condor (25 contracts) for $1,200 premium.

The stop loss, i.e. the buy-back is at $1850, if the condor breaks. We are buying a put position, 2 SPY 385 put 28/10 at $4.82 for which the initial stop loss is at $2.4.

NOTE: when the market drops, please make sure to lock in some profits by raising the stop limit.

For DIA we are trading the following iron condor: 306/307 to 319/320 DIA 28/10 (25 contracts) for a premium of $1,125. The stop loss, i.e. the buy-back is at $1700, if the condor breaks. We are also buying 2 DIA 28/10 319 put for $3.07. Initial stop loss is at $1.5.

As mentioned, we lost money on the DIA positions already on Thursday (DIA kept rallying even stronger than SPX throughout the week). But the action on Thursday (described above) allowed us to take profits on the SPY put, annihilating all the DIA loses. The SPY condors were closed on Friday open (after the markets quickly went against us) almost at break-even.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!