Welcome back dear subscribers! The competition is officially open for week 5 in Q1 2022. Last week’s leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post)

Last week we predicted another turbulent week where the markets were likely to end lower. And we were right. It was finally that favorite situation of ours: markets lose money, BASON gains money. However, the decline extended on Friday and finished even lower than our targets, finishing only slightly within our SPY iron condor. Luckily we also had the SPY put as a directional bet that increases profits if SPY overshoots the target, which is exactly what happened.

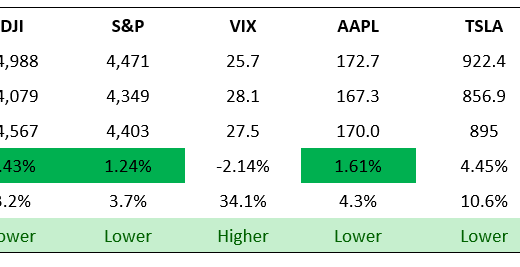

The direction of each indicator except the 10-year yield was called in the right direction, with S&P, DJI, and AAPL falling within our standard 2% margin of error. These are the numbers we’re used to :)

This week the geopolitical situation in the Ukraine is capturing everyone’s attention, so it will be interesting to see how the BASON performs under additional uncertainty and more expected volatility.

Profits for the week?

We finished the week with a 73% return with respect to total exposure ($1850 exposure, $1350 profit), and a 7% gain for the whole portfolio.

As we pointed out last week:

…we sold 10 434/435 to 447/448 SPY 18/02 contracts (the iron condor), and got an immediate $540 (10 contracts * 0.54 price * 100 shares). If we fall outside the condor, we lose $460.

We also bought 1 SPY 18/02 put for $820, acting as a hedge in case SPY breaks the lower boundary. This is a purely directional bet.

…

we decided to play the iron condor for AAPL as well. We sold 10 contracts of 162.5/165 to 175/177.5 AAPL 18/02 for a $440 immediate gain

The directional hedge really helped this week. The iron condor delivered a total profit of $480 (bought it back before Friday close), while the SPY call that was bought for $8.2 was sold on Friday for $12.5 (it went up to > $15, so we could have made even more, but we took our profits in time). This yielded a profit of $430 on the put.

Finally, the AAPL iron condor ended well within its confidence intervals and we took the entire $440.

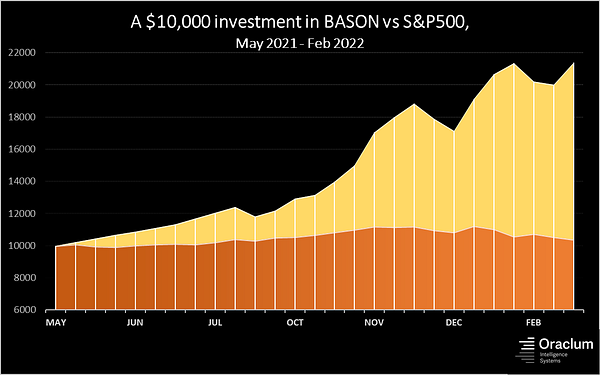

In total we made $1350 last week, helping us eliminate all the losses from Week 2 and Week 3, meaning that BASON returns are net positive for the year!

Overall, the portfolio is up 3.6% in 2022 ($695 to be exact), and is now up 114% since we started doing this. This is incredible given the significant volatility in markets ever since January. Our tweet sums it up:

Long may it continue!

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!