Quick summary:

The 2024 Q1 competition is up & running. Still a great time to enter - click here.

After a good start the week before, last week we got the signal that markets were heading down but were a bit late for it. We started shorting on Wednesday, made decent progress for the day, but it was all annihilated over the next two days. We ended the week with a contained 1.9% loss.

The economy is still looking very strong according to last week’s data. On Thu and Fri we got a tech-induced equities rally, coupled with another sell-off in bonds (yields rallying high again). But more interestingly, we saw a repricing of rate cut expectations, which makes sense. The Fed is less likely to cut with the economy staying hot, and inflation being more sticky.

This week is also fun-packed! We get Q4 GDP and jobless claims on Thursday (both likely to remain hot), and core PCE inflation on Friday (the Fed’s favorite inflation gauge). Earnings releases continue, with NFLX (Tue) and TSLA (Wed) the most interesting ones, but also GE, J&J, IBM, AT&T, Intel, Visa, AmEx, etc.

One more week left before we enter the key Treasury and Fed policy decisions for the next 2-3 months. We will cover it in great detail this weekend and throughout next week. Don’t miss it:

The competition

[NOTE to winners from Q4 and 2023: We’ll start making payments this week, apologies for the delay, we were waiting for final accounting clearance].

Already some changes up top in the leaderboard. This is expected over the first few weeks, some realignment before we see a few people rising up the top. So don’t get discouraged if you had one bad week. The game is very much on.

A quick reminder of what the competition is about.

You make predictions each week on where the S&P500, the Dow, the QQQ (NASDAQ 100 ETF), the VIX (volatility index), the AAPL stock, and the 10 year yield will end up by Friday 4pm ET of the same week.

Survey opens up each Tuesday at 8am ET, and closes at 8am ET on Wednesday. It’s all about where you think the market will end up, and where other people that you follow on social media or hang out with think the market will end up. A bit of wisdom of crowds. Our our survey website you have a video of me explaining how the whole thing works. Also, here’s Scott and myself guiding you through the new version of the survey that came out in Q3 last year.

It is great to start early and be consistent. Consistency is key in trying to win the competition and take home cash prizes. And these are not small. We allocate $5000 to the top 20 participants each quarter (so $20,000 in total, where each quarterly winner gets $1000), plus a 3% share of ORCA’s profits at the end of the calendar year to the annual winners.

As the fund grows its AUM, so will its prizes. Soon enough this will become a competition where you might earn yourself a nice additional income for 10-15 minutes of weekly predicting. And you’re following markets anyway, so why not give it a try?

Looking forward to having you on board!

Last week’s performance

It started off with two days of selling. Wednesday in particular saw a strong move down, but then Thursday saw a powerful bounce-back, particularly after it rejected yesterday’s close. The short squeeze continued into Friday sending SPX to all-time highs, finally breaking through 4,800 (which it failed to do on three occasions a couple of weeks before). In such weeks, when we get direction right, we make a killing.

Not this time though. Our prediction was a continued sell, and by midday Wednesday, it was looking like another good week. But with the bounce on Thursday and continuation on Friday, we were forced to book a loss. Contained at 1.9%, but a loss nevertheless. Too bad, as we do relish these kinds of opportunities of a one-way directional move. Still, no harm done, as we eagerly anticipate what comes next.

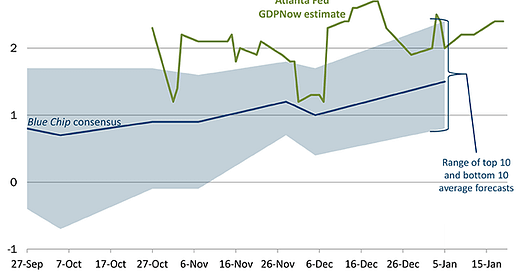

Another packed week is ahead of us. The economic data keeps coming in hot. This week we get Q4 GDP estimate and jobless claims on Thursday. Note that the GDPNow estimate from the Atlanta Fed suggests a 2.5% growth last quarter (see below). That is a pretty good result, and shows no signs of stopping for the US economy. Jobless claims will most likely show a similar trend. And then there is core PCE inflation (personal consumption expenditure) on Friday. This will be a very important indicator for the Fed in its decision on the March rate change. We will be observing closely.

It’s also an earnings week. What does good GDP data mean for earnings? Well, companies certainly made good results if consumption remained strong. We shall see for sure this week, setting the stage for the week after, when most of Big Tech comes in.

This is all still gearing us up for the Fed meeting on Jan 31st. So pay close attention to the data and the earnings this week.

And give us a good prediction on what’s going to go down!

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.