Results: mixed, but S&P predictions still spot on and profitable

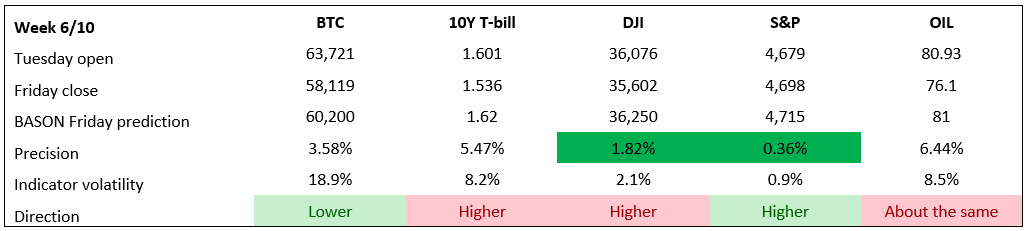

Margin of error 0.36% for the S&P500

Welcome back! The competition is officially open for week 7/10. Get in, have your say on our 5 indicators and 4 stocks, and keep pushing for that $1000 prize! The leaderboard is updated within the app, check to see where you’re at.

Last week was a mixed bag. A lot of indicators overshot our estimates, half were called incorrectly, but the S&P500 prediction was once again spot on (0.36% margin of error) and profitable. Mind you, this prediction came while the S&P was on a downward trend for the week, but as we said on Thursday (and to our competition participants on Wednesday morning): “we’re confident the S&P500 will end up higher”.

The Dow ended up within the usual 2% margin of error, despite being called in the wrong direction (high precision, low accuracy). The 10-year T-Bill and oil prices went the other way, while BTC, even though it was called correctly, went down a few points further.

During Thursday things were looking much better, with the S&P going even closer (4708 at one point, compared to our 4715 target), the Dow moving in the right direction as well, BTC hovering close to our 60k target and oil climbing back to $80, but then on Friday they again moved in the opposite direction to end the week lower, slightly increasing our errors.

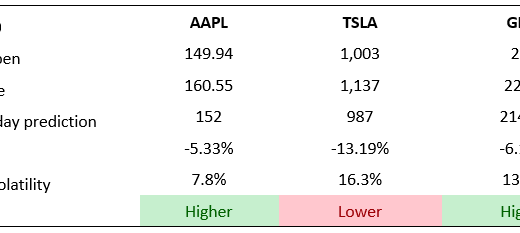

Stock predictions, on the other hand, significantly overshot our predictions. TSLA was a big miss, both in terms of direction and in terms of the price target. We estimated that Musk’s selling will continue this week (he did start on Monday, selling off another billion, but the sell-off did not continue), so the price went up, and it went up a lot, 13% from its Tuesday open. GME also overshot by 6%, AMC failed to do the same, while AAPL, even though we called it in the right direction, overshot significantly (ended up at an all time high of $160).

However, if you had bought calls on each of these, the gains from AAPL and GME would more than offset the losses from TSLA and AMC.

Having said that, it’s a shame for these misses, but the underlying performance is still very good.

SPY profitability: 62% return for the week!

Especially for the S&P500.

This was our investment strategy for last week:

However, we’re confident the S&P500 will end up higher, and have backed this up with 2 SPY 19/11 calls at 462 strike (break-even after 468), with an estimated profitability between $400 and $1000 if it stays within our limits.

As always, we used the usual iron condor for the SPY 19/11, at 466/467 to 474/475, selling 10 contracts for an immediate $400 gain. We get to keep the $400 if the price remains within this narrow corridor upon expiry on Friday.

Total earnings? $400 on the iron condor, plus an addition $440 for the calls, having sold them while the S&P was near our 4715 target during Friday. In total, on an investment of $1365, we collected $840 in profits, meaning the return was 63% last week. Not bad for a mixed performance :)

Overall, the earnings stand at close to $6000 for the first 6 weeks. Thank you BASON, and a big thank you to our users who will be reaping those rewards at the end of the competition!

Stick around, participate in our survey competition regularly to get this info before others get it, and try to make some profits from it.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday morning). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!