Quick summary:

New survey (on our new app) is up & running - click here.

The app launch went really well last week, still working on the full transition of the leaderboard(s)

It was a good week in terms of predictions, and our portfolio was up >2% for the week

S&P500 and NASDAQ are sliding into correction territory

Expect some action this week, we get the CPI and PPI this week, and the Q2 earnings season kicks off.

The survey app launch & some troubleshooting comments

The app launch last week went great! We got a bunch of cheerful comments from our users, and we’re happy to hear all feedback. Even those users which reported some sign-up errors liked what they saw in the new app (thank you again for pointing them out to us - for the record, this bug has been fully fixed). Thanks again everyone for your support!

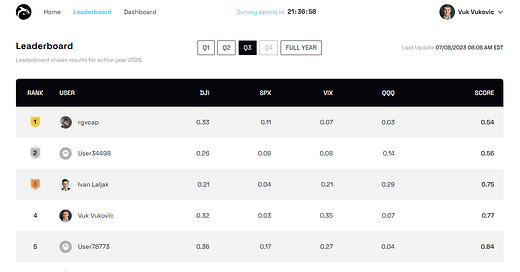

The one thing that remains to get adjusted is the leaderboard. A lot of you noticed that the annual leaderboard was a bit off. All the best performers from Q1 and Q2 are clustered on the lower end of the curve, while a few of the good performers from last week, first time entries into the survey, got all the top spots annually. The reason is that we have yet to implement the penalization for consistency on the annual leaderboard. If you came in from the start, from Q1, you are obviously rewarded much more than someone who just came on in the middle of the year. This will be reflected in your annual performance, so give us a week or so to have this fixed as well.

You might have even noticed my name in there, on the Q3 and annual leaderboards. Don’t worry, I’m not eligible to participate for the prize. I did the survey to get a feel of what it looks like, but my scores will, in the future, be taken out of the competition - as was the case thus far; my data was simply not there. It’s not fair for you to have to compete with me for this :) Although, a few of you are consistently better over the past two years, so kudos!

Also, if you noticed that your name is under “deleted user” in the previous Q1 or Q2 leaderboard, once you log in with the same account, the transition will be automatic.

Finally, isn’t it great that you can now track your performance on each indicator? If there are big differences here (for example, if someone was great on SPX, but their performance on the other three dragged them down a bit), we might think about introducing prizes for individual indicators as well. But that’s for next year, not now.

Without further ado, we invite you to re-join the new survey:

Sign-up first using the same account you used before so that we can automatically connect you to your previous scores.

For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Last week’s performance

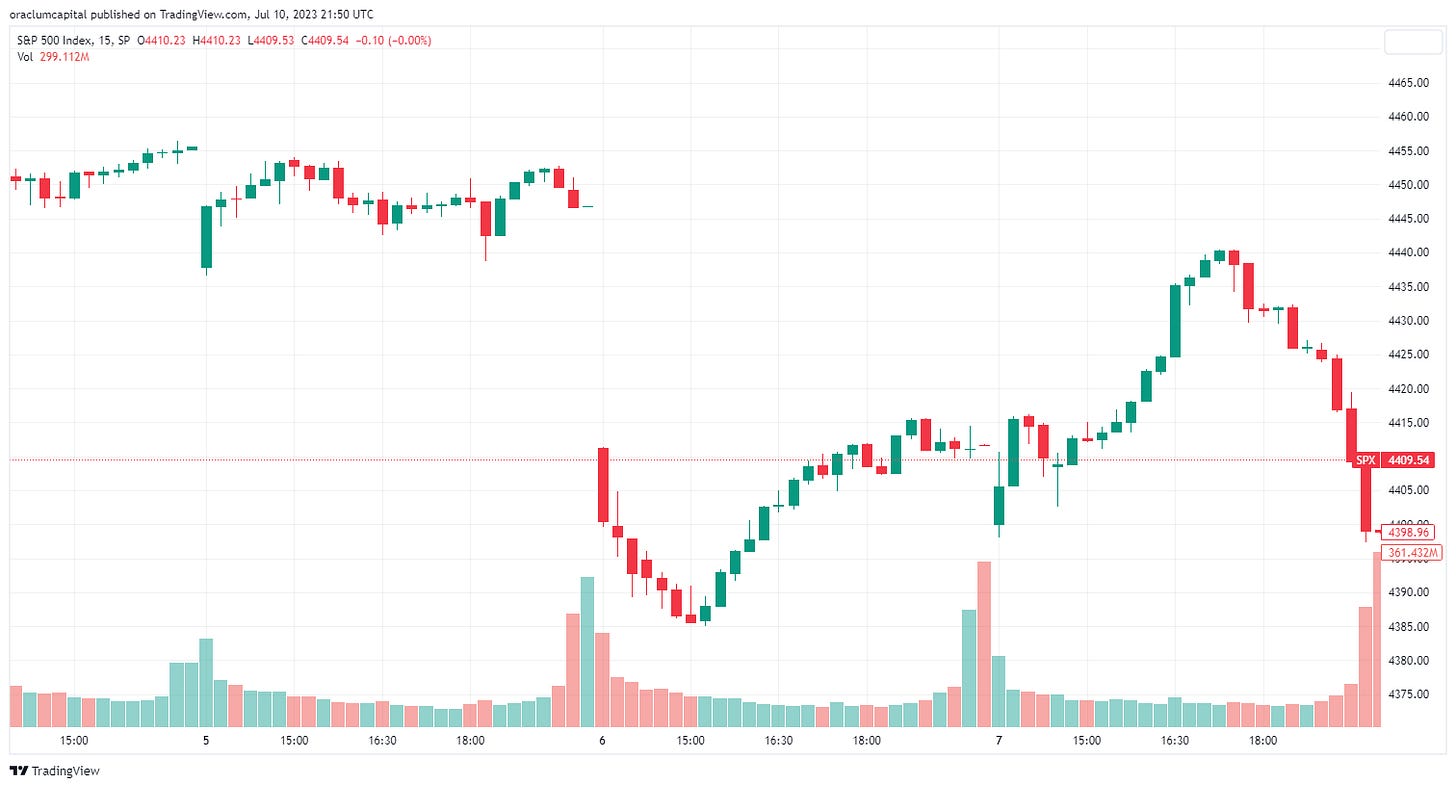

Another short week; markets were closed on the 4th of July on Tuesday, and Monday was a low volume half-of-day trading day. Wednesday continued a low volume trend, with the SPX trading mostly sideways. But then just look at that price action on Thursday and Friday. First a gap down open on Thursday, pushing SPX down to 4,385 only to see it rebound off that level and close above the open. Finally, a gradual push up during Friday was swiftly pulled back in the final two hours of trading. Jumpy in the final hours? This has that distinct 2022 feeling to it.

Our positioning was an expected down move, which we materialized on Thursday open, closing the trade to send the portfolio up by 2.2% for the week.

CPI is coming up this week, at 8:30 AM ET on Wednesday, while PPI will be released on Thursday. Make sure to keep an eye on this and account for it in your predictions. Also, earnings season begins again this week, for Q2. The banks start first, with JP Morgan, Wells Fargo, Citigroup and BlackRock up this week, alongside some other big names like Pepsi, Delta, and UnitedHealthGroup. I’ll have more to say about tactical positioning over earnings in the next blog, coming up this Thursday. Stick around.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!