Quick summary:

New survey is up & running - click here.

Excellent precision last week, only 0.5% error for S&P

However, getting there was a nightmare

Post-CPI, markets first went down 2.5%, and ended the day up 2.5% (5% swing)

This killed our options positions on Thu, but our overall loss was limited to 5% of the portfolio

Last week was a good example of portfolio drawdown protection

Welcome back, dear subscribers. The Q4 competition is now open for its third week. The leaderboard is updated and available within the app. Remember, Q4 opened with a new competition and a $5,000 prize pot allocated to the first 10 users. It’s a whole new ballgame and we welcome your great contributions:

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance and portfolio update

As the title said, what a week!

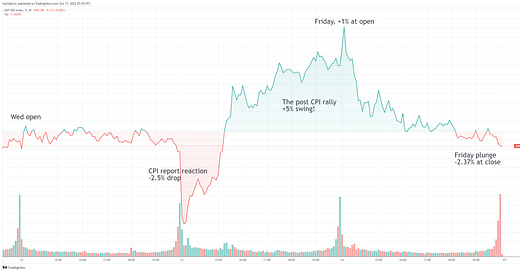

I think it’s best summarized in the chart below:

As you may recall, we predicted the markets finishing lower after the CPI report on Thursday. In other words, we were predicting a worse than expected CPI number (which it was), and that this will drive markets down.

The Thursday open was expected: S&P went down 2.5% within minutes as a reaction to a bad CPI report. Our portfolio was up over 12% for the week at the time, with half of our condor legs stopped out. The puts and the bear call spreads were paying off handsomely.

And then, the reversal. Closing shorts, pricing in the fact that inflation is peaking, volatility crush in the options markets - whatever the reason, the markets started rallying. Ended with a 5% swing since the open.

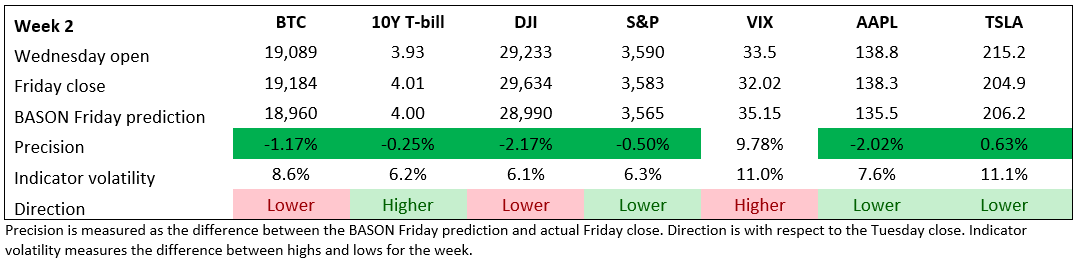

That was only Thursday! On Friday, markets open higher by almost 1%, only to plunge back to a -2.37% to end the week lower than the Wed open when we opened our positions. So yeah, we were right in the end, and with some precision:

S&P ended up being accurate with only a -0.5% error (3,583 vs the predicted 3,565). The 10YT even better, a 0.25% error (4.00 vs 4.01 - we’re splitting hairs here really). TSLA was also really close, 204.9 vs 206.2. Furthermore, despite not getting the direction right on BTC or the Dow, the precision even there was pretty impressive.

But the bottom line is always portfolio performance.

Last week’s volatile price action was a testament to the drawdown protection we have put in place. Despite the swing that could have easily continued into Friday, we only lost 4.75% of our portfolio in total. Yes, all our positions were stopped out already on Thursday. We even split the condors into bear call and bull put legs, to have only one of these stopped out and the other continue in case of large moves that we expected last week. The large moves happened. In both directions.

It didn’t help. The puts and the bear call spreads were all stopped out later on Thursday (filled out at decent prices). The only thing where we made money on Thu were our short hedges (final two rows). They delivered and we closed them by the end of the day to limit our loss positions. New hedges were opened again on Monday (same expiration, same strike).

We entered Friday with only the long-shorts still in place. We opted for no intervention into the options part this time, as we waited to see what happens with the long-shorts. Eventually, they delivered.

A tough trading week, but we managed to protect our drawdown. Yes, the feeling is bitter sweet given our final precision, but even if the puts weren’t stopped out, we still would have had a loss (an even smaller one, but a loss nevertheless).

Having known all this, would we have played this any differently? No. So I guess we could say it was an unlucky week.

Options: all positions stopped out

As mentioned last week, we opened the following options positions:

this week we're trading 350/351 14/10 bull put spread for $875 and 363/364 14/10 bear call spread for $975 premium (25 contracts).

We are buying a put position, 2 SPY 363 14/10 put at $7.7.

For DIA we are trading 284/285 bull put spread for $400 and 295/296 bear call spread for $850 premium (25 contracts). We are also buying 2 DIA 14/10 295 puts for $4.72.

As stated above, all 4 positions were stopped out - the bull put spreads on the way down, the bear call spreads and the puts on the way up.

NOTE: Given that we are now presenting portfolio performance overall, it makes little sense to continue presenting options results separately - particularly since the numbers are different. The portfolio overall is now $50,000, whereas the options were being built on an initial $10,000 out of which only $2000 were used for the strategies each week. So we’ll retire the options graph for now, but will present the portfolio tracking graph by the end of each month (and present weekly results in the table above).

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!