Quick summary:

The Q1 competition is up & running - click here to join the action.

SPX ended February down 1.2%, NDX dropped 3.7%, and most asset classes are negative YTD. Gold (+7.4%) and bonds (+5.5%) stand out as the only strong performers, signaling a shift toward recession hedges.

The same sentiment continued yesterday as Turmp’s tariffs are now a reality: 25% on Mexico and Canada, up to 20% on China. It’s beginning to look a lot like early 2018. More on this in this week’s paid section!

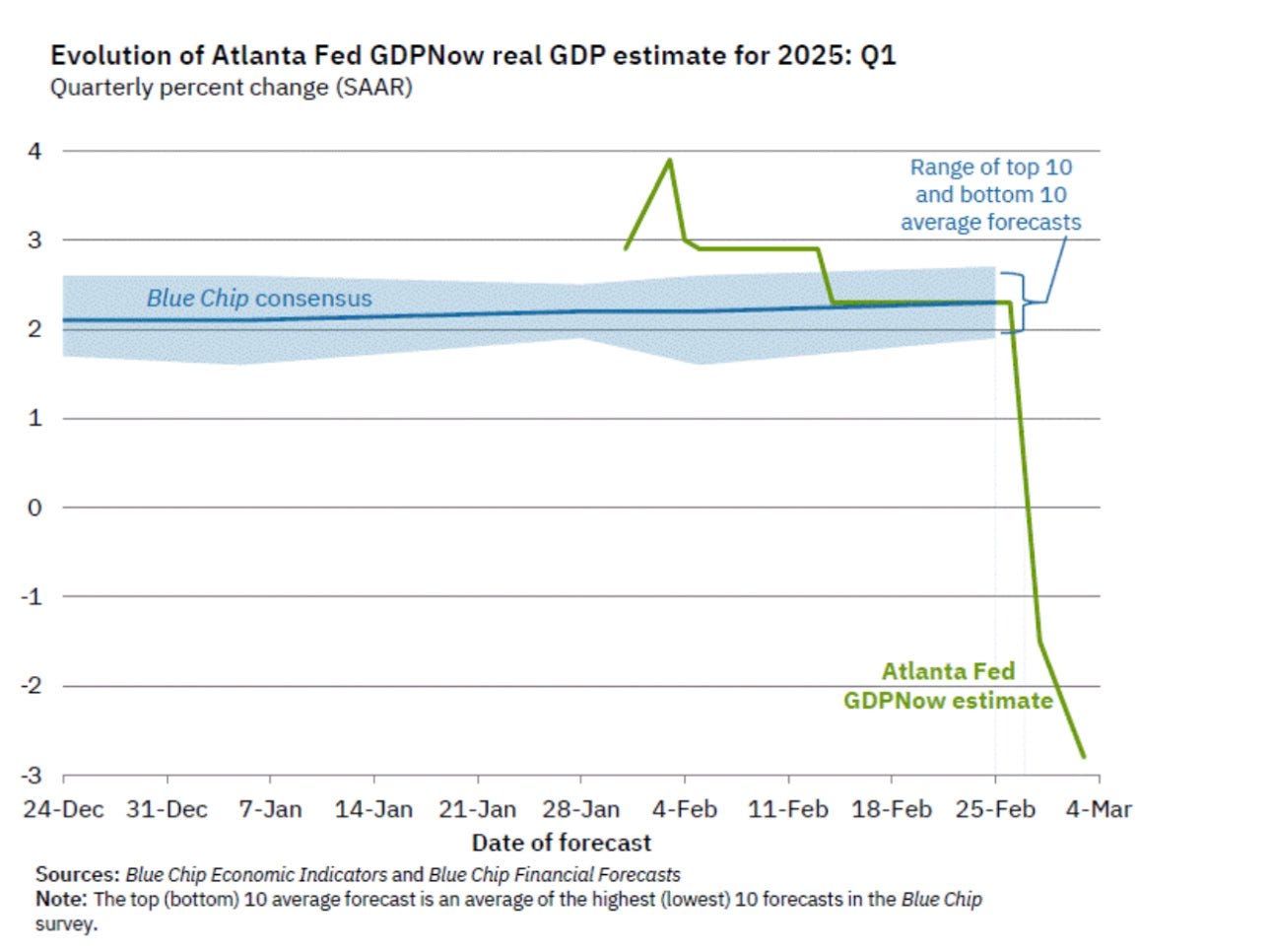

The Atlanta Fed’s GDPNow forecast plunged from 3% to -3% in just three weeks, suggesting the "higher for longer" narrative is fading, and is being replaced by the recession narrative. A big tailwind for markets, as we’ve emphasized a few times (see here or here).

We have been bearish the past few weeks, suggesting to our paid subscribers that holding hedges is the smart thing to do. Yesterday, hopefully it paid off.

The competition

With Trump’s address, new tariffs, and the jobs report ahead, this week could set the tone for what’s next. It’s also the last month of Q1—time to stay sharp, ride the momentum, and make our move up the leaderboard.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Markets took a hit last week, confirming the weakness we’ve been talking about. Despite NVDA’s strong earnings, the stock got slammed, dropping 8% the next day. SPX ended February down 1.2%, while NDX fared even worse at -3.7%. SPX is still slightly up YTD, but most asset classes, including crypto, are in the red. The two exceptions? Gold (+7.4%) and bonds (+5.5%)—a textbook recession trade.

Last week’s end of month rebalancing in the final hour of trading almost annulled the entire sell from the day before, but even this was short-lived as Monday’s 2% sell-off in SPX was the proper reaction to the realization of Trump’s tariffs. It’s a very similar environment to February and March 2018, when Trump did this with China.

However, this time it could be worse for the economy. The Atlanta Fed’s GDPNow forecast plunged from 3% last month to -3% now. In just three weeks! If that holds in the actual data, the “higher for longer” narrative is done, and the risk of recession is way up. The market is front-running this shift, pricing in weaker growth, lower rates, and trouble ahead. We’re certainly in correction territory.

This week brings more potential volatility, with Trump addressing Congress on Tuesday, the same day new tariffs on Canada, Mexico, and China take effect. Friday’s February jobs report will be the big test—last month’s weaker hiring numbers already raised concerns, and any further softness could push recession fears even higher. We’ll also get key reports on consumer credit, trade balance, and factory orders, while Fed officials make their final remarks before the blackout period.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.