Quick summary:

Last week in Q4 and the entire 2023 competition. If you’re still within a fighting chance, don’t miss it! The survey is up & running - click here.

We announce the winners of Q4 and 2023 next weekend. The race is tight!

Nothing special last week, a big move down, followed by a rebound, we finished the week basically at breakeven (a very small loss of 0.3%)

To our paid subscribers, we delivered the bull 🐂, the bear 🐻 and the ORCA 🦈 view for 2024. We will keep revisiting our hypothesis as market conditions change over the year (as they most surely will). Keep reading to stay ahead of the curve:

Merry Christmas dear readers! 🎄

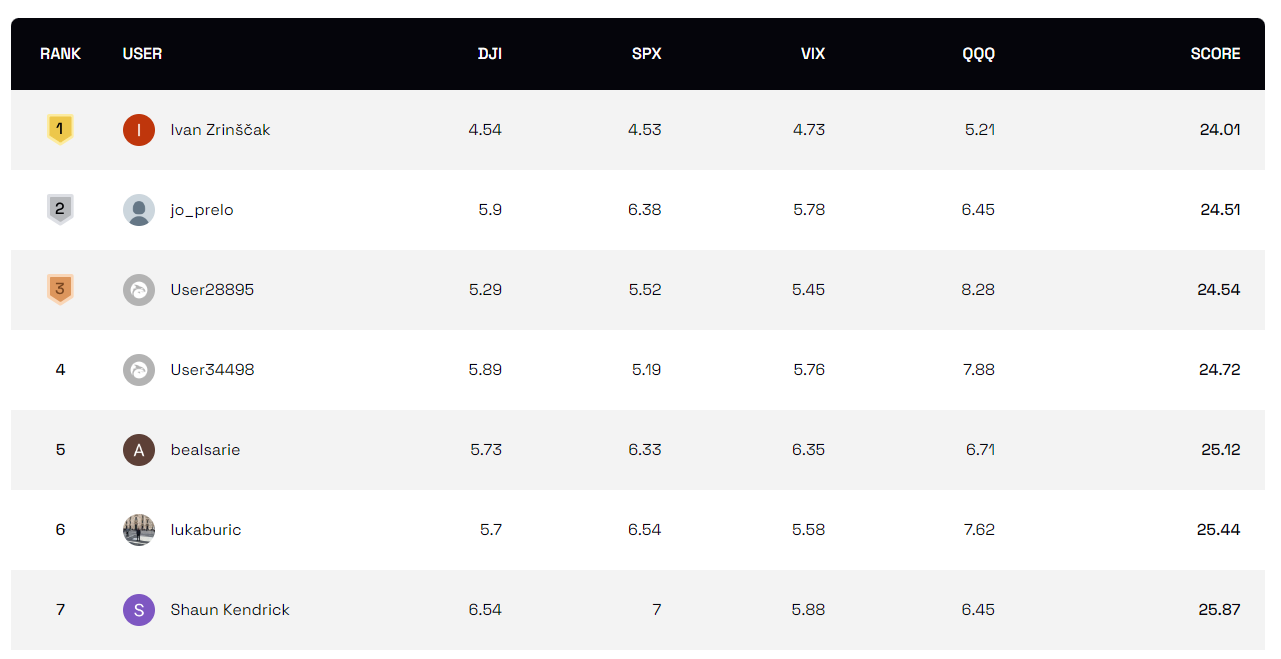

The final week of the year has come. It all comes down to very thin margins, in both the Q4 quarterly leaderboard as well as the annual 2023 leaderboard.

In Q4 we saw a few more changes up top from last week, but the first four remain separated by only 0.7 points 🤯 That is impressive! The margins truly matter here, and we wish you all the best of luck in your final week.

Similar for the 2023 annual leaderboard, although here only the race for first place is the focal point of attention. 0.5 points separating the first two participants (see below). The user holding second place won the first two quarters this year, just to remind you. But with the race this tight, not even that might be enough overall. So what’s the strategy going to be this week? Play it safe, hoping the other person does the same, or take on some more risk in making the final prediction? Anxious to see the results!

Huge congrats to all, and a big thank you for your persistence and your continuous support. You shall all be rewarded in the new year.

As said last time, we’ll announce the winners of both Q4 and the annual competition on Dec 30th (day after the markets close for the year). We’ll pay out the prizes for both Q4 and the annual ranking together, but only after we get our final calculation of the fund’s total profits for the year, and allocate the 3% of our profits to all of you worthy participants.

Note: for next year, the competition will reopen on Jan 9th.

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

It was supposed to be a rather dull week, with the most important indicator - PCE inflation - coming up on Friday. But on Wednesday, just as the calm was hitting markets and we were growing slowly, big sell orders hit the market and we slid 75 points on the SPX. Funny enough, this was obviously a one-off as we bounced back on Thursday, to finish up 1%, and continued the climb on Friday after PCE. So the entire move was basically reversed rather quickly.

We had an up signal for the week from BASON and kept call spreads active. The Wednesday decline pushed the entire position down to over 1.5%, but we bounced back the next two days, although never really recovering in full. We closed the week with a small, 0.3% loss.

No major economic data coming out, no earnings, no Fed speakers. Last week of the year, typically lower volume, but beware of potential surprises like the one from last week. And have a great week!

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.