Quick summary:

The twelfth week of the Q2 competition is up & running - click here to join the action. Two more weeks left in Q2. Make them count!

CPI came in at 2.35% last week, below expectations, helping markets early in the week—until macro pressures and rising geopolitical tensions reversed sentiment by Friday. Oil spiked 8%, gold neared all-time highs, and equities fell after Israel's strike on Iran reignited concerns across markets. And then on Monday, equities jumped back up again (s we said they would in our Saturday piece), and gold and oil went down.

All eyes on Wednesday’s FOMC meeting, with markets watching for any shift from the expected two rate cuts in 2025; VIX expiry on Wednesday and quarterly OpEx on Friday could add to volatility if the Fed surprises on either sides (hawkish or dovish).

May retail sales and housing data will give a fresh read on consumer and construction activity, while Israel-Iran tensions and tariff concerns keep pressure on commodities.

The competition

The Fed’s dot-plot lands this week, oil’s on the move, and we’ve got just two weeks left on the board. With CPI behind us and OpEx flows ahead, now’s the time to press.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Markets initially reacted with optimism last week after CPI came in at 2.35%—slightly higher than April but below the expected 2.5%. Core inflation showed a similar trend. The decline in car and apparel prices likely reflected early tariff impacts, while lower energy prices and firms holding off on passing costs to consumers helped keep inflation tame. Still, macro flows weren’t supportive. By Friday, sentiment flipped after oil jumped 8% on news of Israel’s strike on Iran, gold surged back near all-time highs, equities dropped across the board, and bond yields spiked. Classic panic move overnight, intraday reversal, then a flush—more about macro concerns than just geopolitics.

However, as of Monday all of these moves were reversed, as we have anticipated on Saturday:

In terms of the Israel-Iran conflict, things most likely will escalate over the weekend and into next week, but I doubt there will be a bigger impact on US assets than what we have seen on Friday.

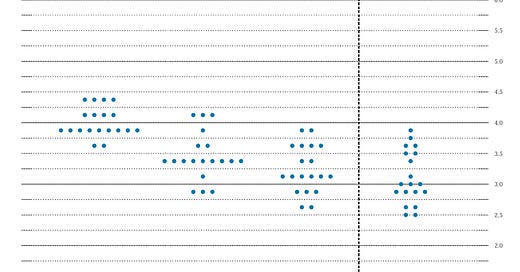

The FOMC decision and dot-plot update are due Wednesday. While no cut is expected at this meeting, markets are watching closely for any change from the current expectation of two rate cuts in 2025. A move toward three would likely trigger a rally, while a shift to one could bring another round of selling. We covered different scenarios in our paid section over the weekend. According to the March dot-plot (see below), a lot of FOMC members need to be persuaded to get us to more than two cuts in 2025. Not so many have to move up to get a bearish view of only a single cut.

On top of that, quarterly OpEx and VIX expiry both land on Friday, while the Juneteenth holiday midweek shortens the trading calendar and adds to the potential for choppy action.

Won’t be an easy one to predict, but I’m sure you’ll do a great job!

Adding to the mix are upcoming macro prints like May retail sales and housing starts, which will offer more insight into consumer strength and builder momentum. With consumer spending making up about two-thirds of the U.S. economy, the data could sharpen the market’s read on growth. Meanwhile, Iran’s decision to pull out of U.S. talks and the broader tariff backdrop continue to stir geopolitical and inflation concerns—especially across commodities.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

headache .... psycho attacks .... where is all this leading .... the world is being led by psychotics .... for some of their own conceited ideas - the quasi betterment of us all .... sick