Why the paywall?

Because it works.

The short macro trade

What a week. That was some reaction post-FOMC, on Thursday. Pretty much in line with what we expected.

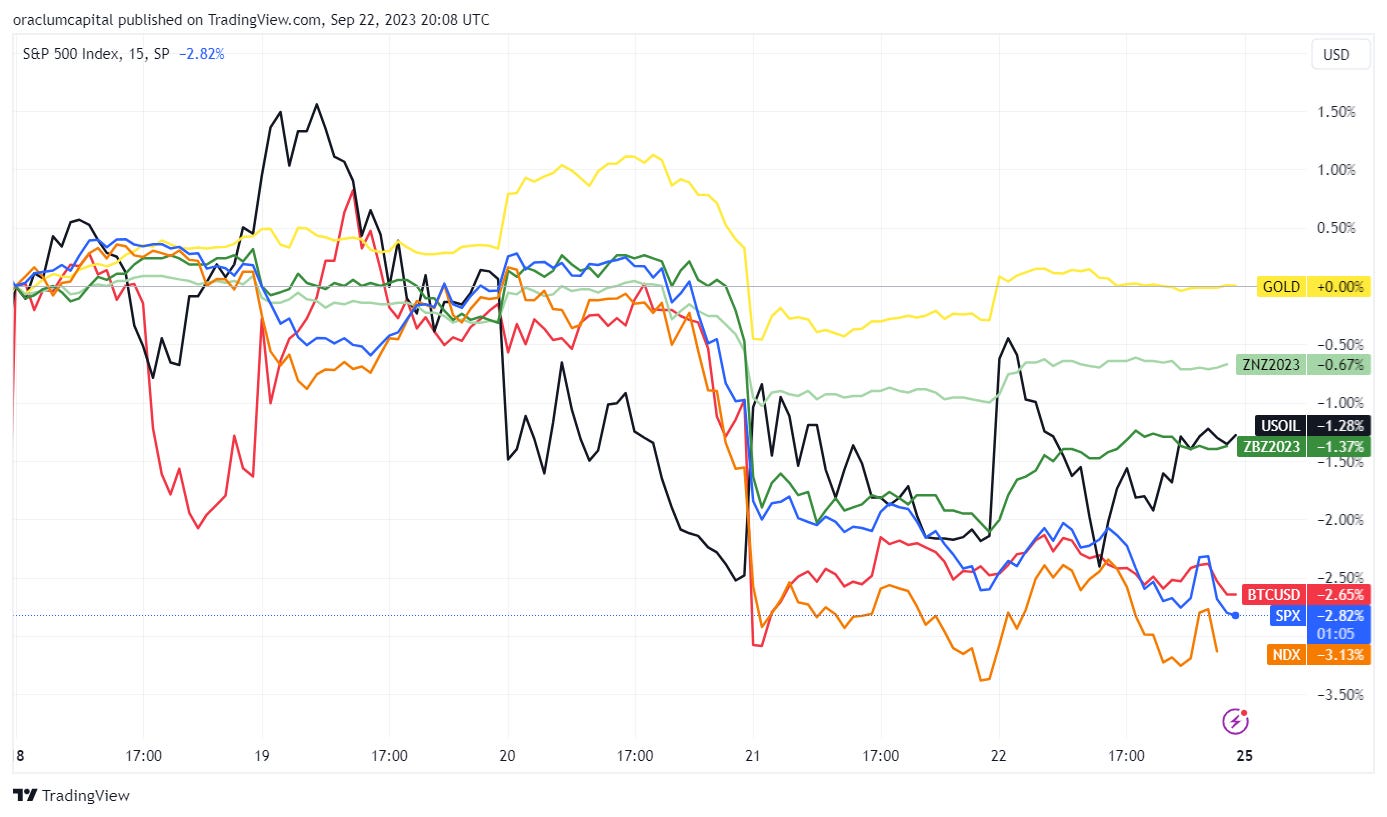

It was a week where all asset classes finished negative. Equities, bonds, crypto, oil, even gold - all sold off sharply on Thursday (except oil which rallied briefly, while gold recovered to end the week at 0%). All assets falling together at the same time (correlation going to 1) is never a good sign. Why? Because it suggests panic mode, and quick repricing of expected outcomes (like lowering the probability of a “soft landing” and the “new bull market” narrative). This might not be over yet given that next week Q3 ends, and big players will engage in portfolio re-balancing. We’ll do a special post on that mid-week.

After all, remember what they say about September being the worst month for stocks.

Our macro shorts, initiated last week after CPI, delivered a stellar return.

314% gain on S&P500 put spreads (bought for $14, trading today at $44)

270% gain on NASDAQ put spreads (bought for $48, trading today at $130)

This is just on the positional hedges, which were about 4% of the portfolio, but the overall impact was an almost 3X gain on both, thus presenting a very good hedge against the longs. These positions opened well in the red last Thursday during the short squeeze, but we held on. Fade short-term moves, maintain the strategy.

Obviously, profits were taken. After such big moves, taking profits is a must. Afterwards we can always just reload.

On Tuesday, our new podcast comes out and we’ll go through the things that occurred over the past two weeks. We had our best week year-to-date, primarily thanks to BASON’s great predictions this week. We’ll cover that on Tuesday as well.

Paid subscription?

We announced our very profitable positioning to our group of paid subscribers last Wednesday. Similarly to how we announced our weekly shorts and longs throughout July and August. Only this time, they were behind a paywall.

Why the paywall?

Because you get to read research insights from a hedge fund based on which we make actual investment decisions. Not paper trading, not suggestions. Real trades, real money made for our investors.

Most hedge funds make complex trades, very often with opaque instruments typically unavailable to regular people, and hidden behind a veil of deliberately convoluted terminology. People neither understand that, and almost certainly cannot replicate it.

My idea is to change this, and make these seemingly complex trades and positions easily understandable, without dumbing them down. Investing is complex, it requires a lot of critical thinking and tinkering, but that doesn’t mean it should be limited to the ivory towers of finance.

That’s why we offer paid subscriptions. Hedge-fund-level research insights targeted towards people who want to better understand investing and where markets are heading.

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

NOTE: We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over investing directly into the fund.