Before we jump in, a quick summary of our year:

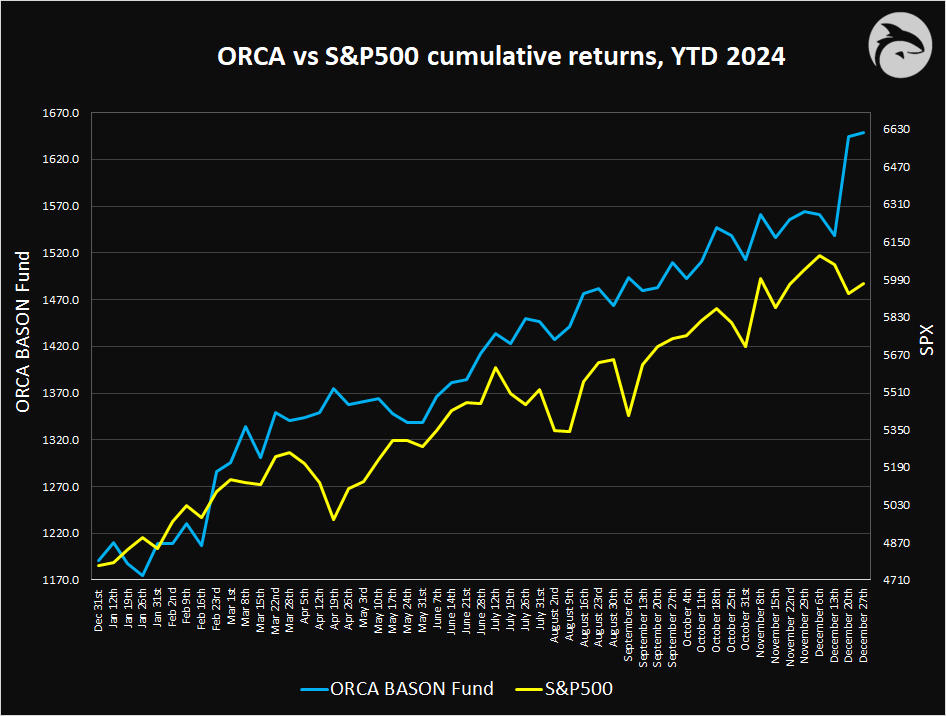

38% year-to-date returns (gross, 30% net), 65% since fund inception (Feb last year)

Comfortably beating all of our benchmarks, with a low correlation to the market (0.13) and low volatility.

Welcome to the ORCA 2024 year in review:

In today’s newsletter, in the first part we will cover our performance this year, and in the second part announce our competition winners.

NOTE: There is no survey competition this week. We start again on January 8th.

IMPORTANT: Today we announce survey winners, but expect our team to reach out early next week (still on holidays this week) for the prize payments. Congrats to all of you who are in the top 20 of the quarterly and annual leaderboards! See more below 👇

ORCA BASON Fund in 2024

We have prepared a video that gives you a detailed overview of our year, plus a few of our plans for 2025. Have a look:

Last year, if you recall, our keyword was volatility. It was a year full of ups and downs, and a year in which we successfully climbed out of a hole we dug ourselves into back in March 2023.

This year, a keyword that sums up our annual performance has to be - consistency.

Our performance numbers for 2024 speak volumes. Not only did we manage to beat all the benchmarks, and by some margin, but we did it with very low volatility, and a very low correlation to the market (see table below).

Our strategy has once again proven its superiority. In 2023, we ended the year with 19% returns, but we emphasized that we made 37% since our March lows, when we fixed everything that went wrong. That number is a much better indicator of the strategy itself, stripping away all other factors. This year we almost repeated that same number and delivered 38% gross returns.

Therefore, the pure BASON, for two years in a row, delivers close to 40% gross returns. Despite everything the markets threw at us. Gradually trending up, one week at a time, with a few spikes that enable the compounding of weekly returns. That truly shows consistency. We have no reason to expect anything less in 2025.

The correlation reported is the correlation to the S&P500. Such a low correlation of only 0.13 means that ORCA delivers regardless of whether the market is going up or down. At the same time, an annualized Sharpe ratio of 3.4 (measured as average monthly net risk premium divided by its standard deviation) shows how low our average volatility really is and how good our risk-adjusted returns are.

The averages can be deceiving though, as we had two weeks of over 6% this year, and three weeks of over 3%. In those 5 weeks came the majority of our returns.

This is exactly how our strategy usually works. Our BASON signal is correct about 60% of the time, but over the year we will make small weekly gains, around 1-2% in about 25 weeks, small losses of around 1-2% in about 18 weeks, and then 7-8 weeks each year we make weekly gains of 5-6-7%.

Every week is a new game. Uncorrelated to the one before. Because of this it becomes very simple for us to successfully maintain our risk management. We never risk more than 2% of the entire portfolio to buy our weekly options positions. Even if the market drops 20%, and we are positioned long that week, we only lose 2%. And next week, we start over.

Benchmarks

We have beaten all of our benchmarks for this year. Ever since Q1 we have been neck and neck with US equities and gold, with gold overtaking us at one point in Q3. In Q4, after the November elections US tech stocks shot up (pushing the NASDAQ above us at one point), and gold went down. But then, in that final push on the week of Dec 20th, we have overtaken every single asset class that we track, including both major US equity benchmarks, as well as gold. Even our net gain, of around 30% is still above almost every single asset class, and in line with the NASDAQ this year.

Looking at other asset classes, they all trailed behind US equities and gold this year. European equities delivered 7.7%, Chinese finally recovered to deliver 17.5% this year, slightly below the MSCI World equities index (again mostly driven by US stocks). Commodities were mostly flat in the year of declining inflation, while bonds are still the worst performing asset, for the third year in a row. A period of elevated inflation and high interest rates is not ideal for bonds and as long as this is the macro environment you can expect yields to stay high, and bond prices to go down.

After filling out the form, you’ll get an email from us inviting you to a 30-minute call with me. We’re happy to keep you informed about our monthly, quarterly, and annual returns.

Note: the expression of interest is non-binding, it does not represent financial advice, nor can it be interpreted as direct investor solicitation. We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.

Competition winners!

Our Q4 competition has come to an end, and it was packed with action. Everyone did their best to make accurate forecasts and compete strongly. Our participants really showed their skills this quarter, and we're excited to announce the Q4 competition winners who stood out with their exceptional performance.

As the last quarter of the year concluded, it was a tight race to the finish with a slim 0.23 point difference between the top two scorers. A huge round of applause for all our contestants, and a special congratulations to User88917 (user wishes to stay anonymous), who emerged as the winner with their exceptional performance, securing the $1,000 prize.

Everyone in the top 20 gets rewarded, so the rest of the $4000 prize money is distributed according to the rules of the competition ($600 to second place, $400 to third, and so on. Places 11 to 20 get $100 each). Excitingly, our new reward system for our survey competition in 2025 will offer enhanced incentives and opportunities, further celebrating the achievements of our dedicated participants. So make sure to participate regularly from now on!

Here's our top 20 rankings for this quarter.

As we look at this year's list of winners, it's wonderful to see so many familiar names continuing to excel. We appreciate your ongoing participation and are eager to reward your excellent performances.

In the annual survey, the competition for the top spots in Q4 was incredibly tight. Impressively, the experienced competitor known as User78773 secured first place, edging out User88917 by just 0.12 points, with User24345 closely following in third place. All wish to remain anonymous.

NOTE: Please give us until the end of January to distribute the rewards, both annual and quarterly will be paid out together. We need to get the final accounting package done to calculate the full performance fees across all investors, take out the performance fees, and then we allocate the 3% of our profits to all of you.

Here are our top 20 rankings for the entire year:

Congratulations to all of you making the top 20 in both the quarterly and the annual rankings. We look forward to paying you your well deserved prizes!

Finally, thank you all so much for your trust and support, we hope we have fullfiled or even exceeded your expectations.

With that we wish you all a very happy new year! May it be prosperous and successful, and may the markets be steady and predictable - to whatever extent they can :)

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

Happy New Year 2025 to all of you and I wish you good health in 2025 y.