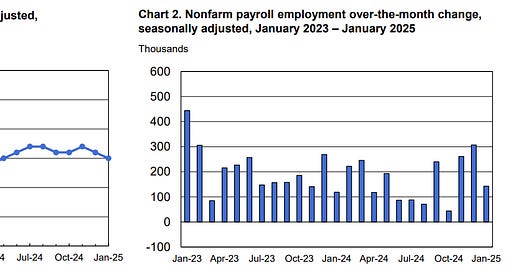

The monthly employment report came out yesterday and added another confirmation to the higher for longer narrative. Job growth was slightly worse than expected (143k added vs 170k expected), but unemployment was better than expected (4.0% vs 4.1%), and is trending down. December revisions went up, suggesting even more jobs were created than initially reported. And finally, hourly earnings went up more than expected (+0.5% vs +0.3%), meaning wage growth continues to put upside pressure on inflation.

And then, during the day, the Michigan consumer survey came out. And it was a shocker:

"Year-ahead inflation expectations jumped up from 3.3% last month to 4.3% this month, the highest reading since November 2023 and marking two consecutive months of unusually large increases. This is only the fifth time in 14 years we have seen such a large one-month rise (one percentage point or more) in year-ahead inflation expectations."

Now, these are just expectations, sure, and expectations could be wrong, just notice that earlier spike in 2023. But they also tend to roughly follow real price changes. The market reaction was a sharp sell-off (it didn’t help that Trump mentioned tariffs again).

Why? Because, as we pointed out last month, higher for longer is here to stay. Labor markets remain strong and resilient, GDP growth is still high (3% at GDPNow, see below), and the inflation battle is far from over. Soft landing is getting priced down, as inflation is back to being the key data point for investors this year. If market conditions are back to higher for longer levels, then we cannot reasonably expect the Fed to continue cutting interest rates. They might remain anchored at or above 4% for quite some time.

However, maybe, just maybe, the US Treasury might be of some help here.

Today we examine what role the Treasury might play in affecting bond yields and thus potentially relieving some of the macro pressures off equities.

As you might recall, we keep going back to the standard macro playbook where rising bond yields are a bad sign for equities. And bond yields will keep rising in an environment where inflation is going back up and Fed interest rates are anchored at or above 4%. Also keep in mind that market expectations are anchored well above those of FOMC members. That tells you that markets expect the inflation debate to be far from over. And so far, the bond markets have been right. Again.

Therefore, can the Treasury be of any help here? And if so, how?