The Fed cut rates by 25bps, as expected. However, as we said yesterday, the key data input was the dot-plot and the summary of economic projections (SEP).

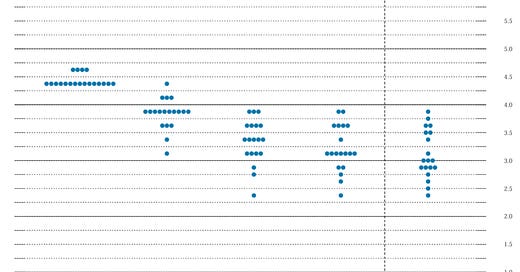

And the projections were very hawkish (bearish). The Fed now expects only two cuts next year - where interest rates would be 3.9 instead of 3.4 as projected in September, and has increased its long run target rate from 2.9 to 3.0 (see table and dot-plot below).

Simultaneously, they see PCE inflation higher next year, and by some margin, from 2.1 to 2.5. This is partially a consequence of higher expected growth, but is clearly a reaction to the higher “uncertainty around inflation” (direct quote from Powell), which basically means a reaction to the Trump administration.

We mentioned this prior to and after the election - if Trump ignites the economy through his fiscal policies and tariffs, it would increase inflation expectations and the Fed will have to slow the pace of cuts, and likely pause. Brace yourself for the showdowns between Trump and the Fed next year.

This was our conclusion yesterday:

If they raise rates to 3.6 (or worse) and the long run to 3.1, with a more hawkish Powell presser (inflation battle still not over, rate cuts much slower ahead) => expect a sell-off in equities.

And indeed, this is what happened.