The Q4 competition is up & running, six weeks down - click here to join the action.

Market reactions were, as we anticipated, volatile last week despite earnings from five of the Mag7 companies exceeding expectations, and decent macro data. A strong sell on Thu was followed by a bounce-back on Friday, but with limited effect.

The U.S. economy showed resilience with a 2.8% GDP growth and a steady unemployment rate at 4.1%, reinforcing the soft landing narrative despite minor impacts from recent hurricanes.

The U.S. presidential election and the Federal Reserve's interest rate decision are the main events this week. A 25bps rate cut is expected from the Fed, which will shape policy directions in light of the new administration. If we even get one this week (another prolonged vote counting cycle is possible).

Hope you read our election and FOMC playbooks. This Saturday we revisit the FOMC decision and its impact.

The competition

NOTE: apologies to some of our European users for last week. EU changed its daylight savings time one week in advance of the US, so some users were locked out of the survey in the final hour on Wednesday. We will warn you in the future when this happens. This week it’s all back to normal, 6 hour difference between EST and CET (5 hour between EST and GMT).

We're entering a big week with the U.S. presidential election and the Federal Reserve's rate decision. This is the perfect time to secure or improve your position on the leaderboard.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Last week closed out as the first of two pivotal weeks, with market reactions somewhat subdued to earnings that outstripped expectations from five of the Mag7 companies—though AMZN and GOOGL shares did see notable upticks. This tempered performance amidst otherwise solid results underscores the cautious stance we highlighted two weeks ago, where investors were advised to brace for potential dips and likely rallies, exemplified by the upswing last Friday. Same for last week, we warned it was going to be a jumpy one.

On the macro front, resilience is evident with GDP growth reported at 2.8%, while inflation remains low and the job market robust, albeit slightly impacted by recent hurricanes, keeping unemployment steady at 4.1%. These indicators bolster the narrative of a soft landing, far from tipping into recessionary territory.

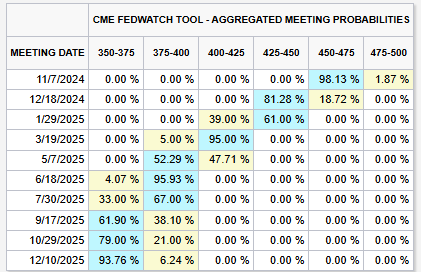

As today’s election unfolds alongside this week's Federal Reserve meeting, market dynamics are poised for potential volatility. Markets have leaned into the "Trump trade," forecasting higher growth and inflation, indicative of a broader expectation for continuity or enhancement of these conditions under his potential leadership. With a 25bps rate cut expected from the FOMC, the approach remains to guide a strong economy towards a gradual decline, which will be crucial for shaping future policy directions in light of election outcomes. Following the election, the focus will immediately shift to the Federal Reserve’s interest rate decision on Thursday. The anticipated 25bps cut and Jerome Powell's subsequent press conference will be crucial in framing the central bank's perspective on the post-election economic landscape, potentially setting the market's direction for the remainder of the year. This is what the market is expecting coming into the week:

Beware of event volatility that’s been building up coming into the election and FOMC day. Typically after the event passes, vol goes down, and markets up. Unless, of course, the outcome of either events shocks markets and we get a strong sell.

What’s your take? :)

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.