Is a recession coming? Almost certainly.

We're at the start of the Fed cycle.

The Fed’s hiking cycle got kicked into a higher gear this week. After a surprising inflation read last Friday (8.6% CPI year-to-year, 1% higher than in April), the Fed raised its reference interest rate by 75bps this week (higher than the expected and announced 50bps hike), bringing them up to 1.75%. The next meeting in July will bring them up by another 75bps, all the way up to 2.5%. The expectations for year-end interest rates are at a whopping 3.4%.

Notice that according to the Fed’s dot-plot graph - depicting individual projections of each FOMC member - the consensus rates are even higher in 2023, and not until 2024 does the FOMC see them coming down again. In my opinion, this is waaay too optimistic (a tail outcome rather than baseline scenario). The Fed thinks the economy will remain strong enough for them to continue hiking and battling inflation without triggering a recession already this year. Wishful thinking, just like most of last year.

Bear in mind, the 10-year US Treasury yield is at 3.2%. This means the US government is borrowing at an interest rate of over 3%! How do you think this will affect the budget deficit and an already high public debt? Same for most other governments (German 10-year yield is at 1.7%, UK at 2.5%, France at 2.2%, Spain at 2.7%, Italy at 3.7%, Australia at 4.1%, etc.). The ECB had to have an emergency meeting this week due to Italian bond yields once again spiraling seemingly out of control (were at 4.2% mid week).

Also, if reference interest rates will be at 3.4% this year, and the US government is borrowing at >3%, how much do you think your interest rates will be on your home loans? How much will a firm get for an investment project? 5%? 6%? More? Remember, when banks set interest rates, the risk-free rate is usually the government yield (reflecting country risk), and their borrowing costs are reflected in the reference central bank interest rate. Expect borrowing costs to go up, and as a consequence consumer spending and investments to go down.

That’s how the Fed cycle usually works. Especially when, as is the case today, interest rate hikes are driven by very high inflation which is accelerating.

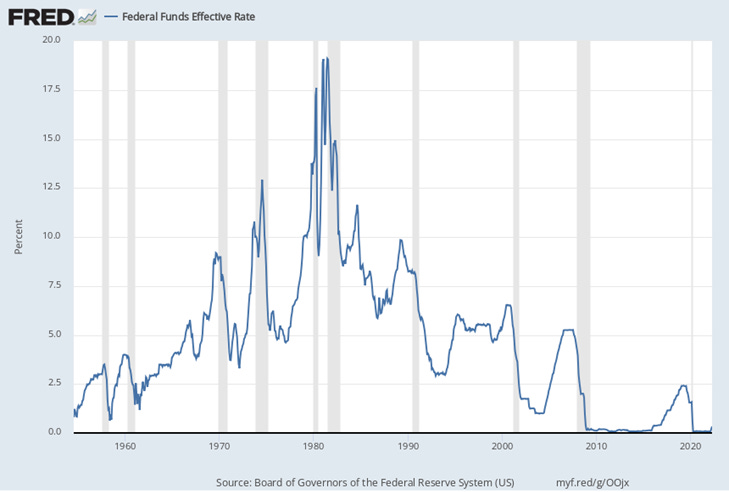

Fed hikes (central bank rate hikes in general) almost always lead to a recession. Check out the graph below (shaded areas are recessions), there were only two exceptions over the past 70+ years, in 1983/84 and in 1994/95. However in both those cases the economy was much stronger, there were no prior major bubbles and inflation was either low or decelerating - in other words the opposite of what we have right now. Also, in neither of those two cases did the yield curve invert (remind yourself what that means). During the current hiking cycle it inverted immediately in March, and is pointing in that direction once again.

Why does this happen? Why do Fed hikes induce recessions? As I mentioned above the first thing that gets affected are borrowing costs. Mortgage rates and credit card rates go up almost immediately (currently the US 30-year fixed mortgage rate is already over 6%). This decreases disposable incomes and people (particularly lower income) start spending less. As a consequence firms sell less stuff, and their earnings go down. The bond and stock market anticipate this early on and start declining way before anyone starts losing their jobs. But people will be losing their jobs when higher borrowing costs start affecting consumption and investing.

An addition factor that is speeding up the cycle is high inflation which is destroying disposable incomes and killing demand. Disposable incomes are down 20% in Q1 of 2022. All due to inflation. (Also notice the spikes in disposable incomes due to stimulus checks in 2020 and 2021 which boosted demand significantly during the biggest supply chain pressures - a big factor in inducing inflation btw).

Case in point - the loan repayment to income ratio is now at 34% (close to 2006 peak). People are spending a third of their incomes on repaying their loans. Obviously less money is left for spending on other stuff. Demand is (already) getting killed.

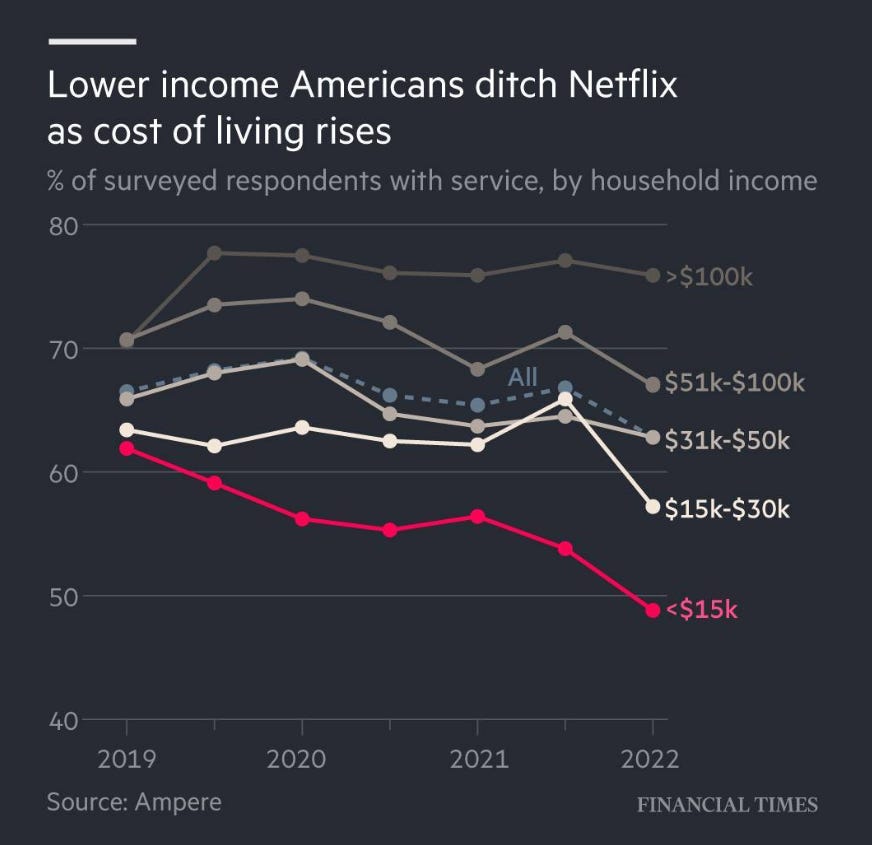

And what’s the first thing that people cut in times like these? Discretionary spending. Like subscriptions to streaming services, for example. This is why Netflix lost so many subscribers in Q1 and why its stock plummeted 40%. Same for low-income retailers like Target or Walmart. People are cutting all non-essential spending. Obviously earnings will be affected in Q2 as well.

Not to mention that consumer sentiment is at recession-level all-time lows. People are feeling the burden of inflation.

Stagflation is thus the baseline scenario right now. A growth slowdown is imminent, and inflation is accelerating. Inflation doesn't go down without more Fed hikes (the 3.5% expectation by year-end), which kills demand, sends markets further down and the economy into a recession.

How to position and are markets bottoming?

Personally, I was short SPY and long commodities since mid-March (shorted at 435) (with option call hedges for the SPY short position), and short QQQ, IWM, and long UVXY (the VIX ETF) mainly through put options continuously in April, May and June. After this week’s performance (worst week for stocks since the pandemic back in March 2020), I closed the QQQ and IWM puts and the UVXY calls, while cutting the SPY short in half. Still keeping part of SPY (and the call hedges) and will consider taking new shorts in July after a new inflation read.

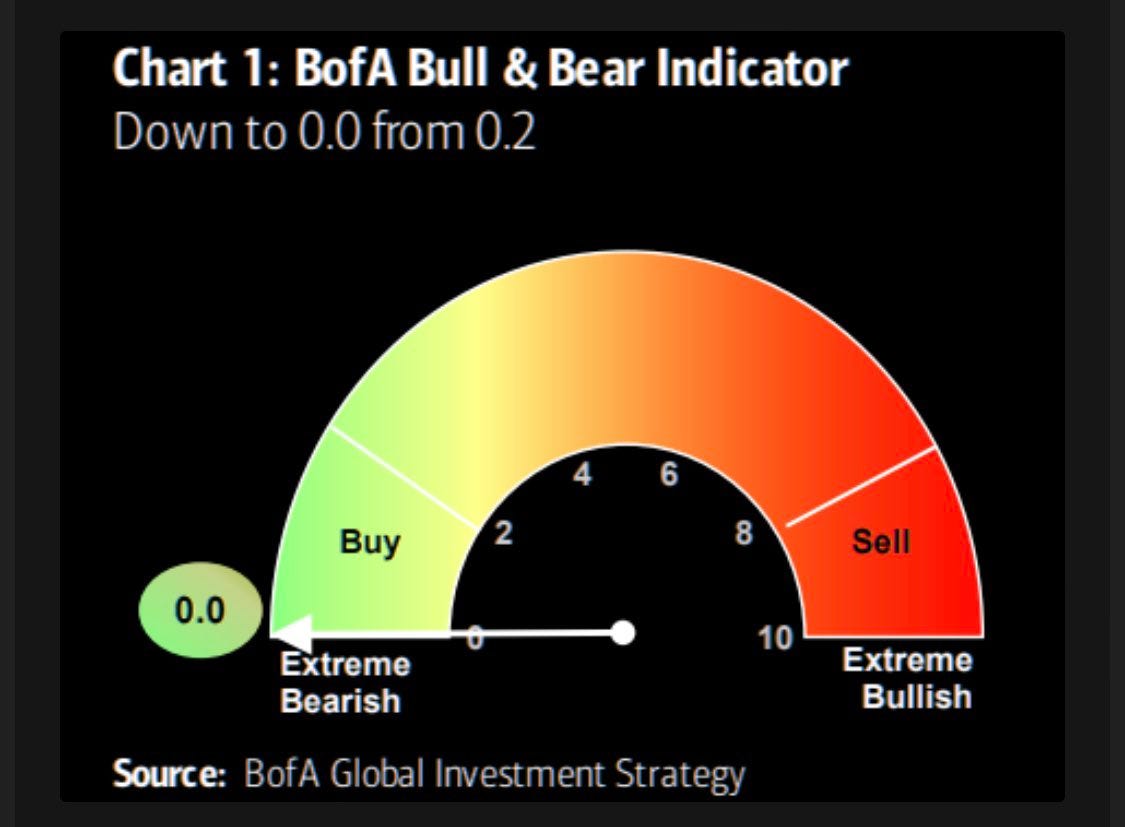

Basically, before the Fed induces a recession and starts signalling a reversal in its hike cycle, there is no point in going long on the stock market just yet. There are indicators suggesting peak bearishness (e.g. the BofA bear indicator below), which to some is a signal to start buying stocks at very low prices. Sure, if you wanna buy and hold for 15-20-30 years, now is a great opportunity to buy. S&P at 3674 is at its 52 week low. The Dow broke below 30k, and NASDAQ is down 30% year-to-date. These are good opportunities, certainly.

But I feel more pain is to come, as the bear market has just started and volatility (the VIX) is yet to signal a major reversal (typically when it shoots over 45).

Don’t fight the Fed :)

A quick announcement at the end - all these topics will be covered in much greater detail and with more applicability in my cohort-based Macro and Anti-Macro course that I’ve launched live yesterday on Maven. Check it out:

The fist cohort starts on July 1st, so sign up and see you in class :)

Thanks for reading!