Predictions for Friday, September 2nd 2022

Quick summary:

Markets expected to finish lower this week once again

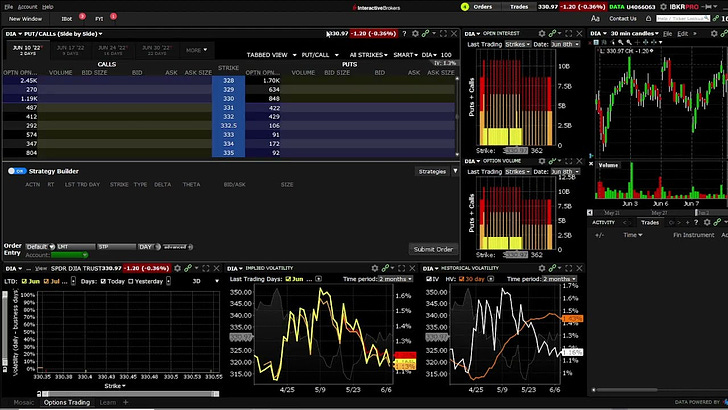

Trading SPY condors at 388/389 to 403/404 and SPY put at 403

Trading DIA condors at 312/313 to 322/323 and DIA put at 322

Again, no separate legs, just the regular old iron condors

Watch this tutorial video to see how we trade this and how to

interpret our predictions:

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

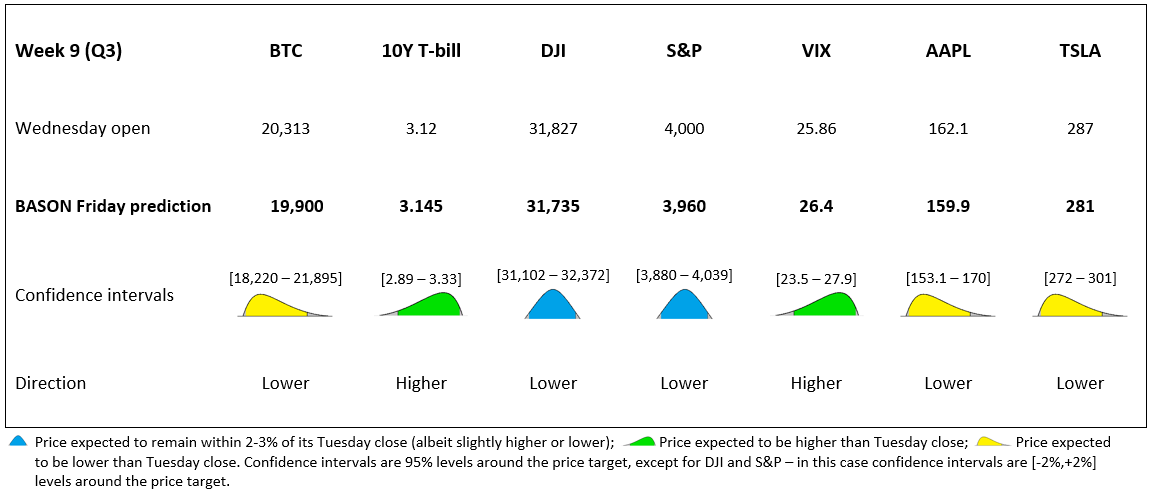

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, September 2nd, 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

Looks like a continuation of the sell-off that started on Friday (which we correctly predicted last week). All three days this week finished lower, and the BASON anticipates this to continue.

If the sell-off continues today and on Friday, it could break through our condor confidence intervals on the lower end. This is why the puts are in place (unless they get to their own take-profit levels today already, at 100%). Either way, we stand to make a decent weekly return.

It will be an interesting two days, no doubt.

How did we trade this?

As per our predictions, this week we're trading 388/389 to 403/404 SPY 02/09 iron condor (10 contracts) for $450 immediate gain. This time there won't be two separate legs, as the condor strategy has a lower loss potential than by separating the legs. Stop loss is at 50% (around $270 max).

We are buying a put for downside protection, 1 SPY 403 put 02/09 for $6.13

For DIA we are trading the following iron condor: 312/313 to 322/323 DIA 02/09 (10 contracts) for $400 immediate gain. We are also buying 1 DIA 02/09 322 put for $4.65. Stop loss is at 50% for all.

In addition, we are buying 100 UVXY contracts, at $10.18 per share. 5% stop-loss. The explanation is here.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.