Quick summary:

New survey is up & running - click here.

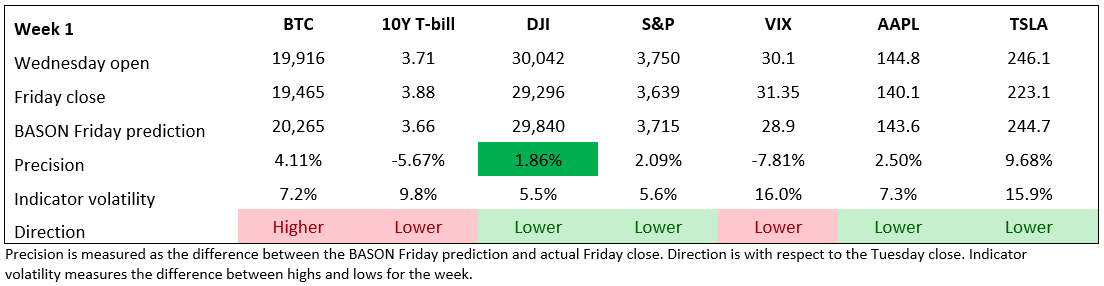

A good directional prediction although with lower precision

Overall portfolio (BASON + macro) is up 1.4% for the week (157% overall)

The old, options-only strategy is up +299% overall, +90% in 2022

CPI inflation numbers coming up on Thursday!

Welcome back, dear subscribers. The Q4 competition is now open for its second week. The leaderboard is updated and available within the app. Remember, Q4 opened with a new competition and a $5,000 prize pot allocated to the first 10 users. It’s a whole new ballgame and we welcome your great contributions:

Don’t forget, this week it’s all about the CPI report coming up on Thursday!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

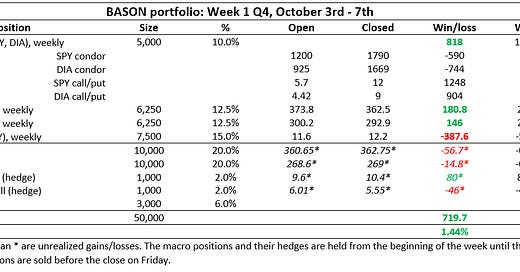

New: introducing the portfolio update

As announced twice already (and as seen on Twitter on Friday), as of Q4 we will present our results a bit differently. In addition to the usual tracking of our amazing BASON options strategies, which will still carry on, we wanna offer you a full insight into our entire portfolio.

A combination of long-short strategies (40%), options strategies (10%) - both of which are based on BASON - and the general macro strategy (45%), which I occasionally write about here as well.

You’ll be able to track how the combined BASON portfolio is holding up each week, just like you tracked our options portfolio. Bear in mind, this is the portfolio that delivered a 155% return over the past 15 months.

So let’s have it, full transparency:

Now mind you, this performance will not have the 100%-gainers each week like you might have gotten used to with our options returns. Instead, it will have a slow, steady weekly progression. Profits for the BASON-based strategies - the long/shorts and the options - are realized each Friday (the profits and losses realized above the middle line - profits are in green, losses are in red), while the macro plays and their hedges are more long-term and they are only realized when they reach a quarterly target, or when the macro picture changes dramatically - but rest assure, we’ll cover that in detail when it happens. This is why they are shown in italic in the table.

Overall, last week we realized 16% gains on the options play (more on that below), 5% on the SPY and DIA weekly shorts, and lost 5% on the UVXY short - this was our biggest miss for the week. We projected that even though the markets would end up lower, so would the VIX. But that one we got wrong, and our losses on it were, a usual, limited.

The direction was great for S&P, DJI, AAPL and TSLA, but wrong on the VIX, the 10Y yield, and BTC. Precision was not great, which is why our condors suffered, but the puts more than made up for it.

Overall, a gain of 1.4% is not a bad week. These gains accumulate and build up a return of 157% since May 2021.

This week, the CPI numbers are coming out on Thursday, and they are likely to have a strong impact on the last two days of trading. What’s it gonna be? A relief rally or a sustained sell off?

Options: puts saved the day!

As mentioned last week, we opened the following options positions:

this week we're trading 364/365 to 378/379 SPY 07/10 iron condor (25 contracts) for $1200 premium.

The stop loss, i.e. the buy-back is at $1800, if the condor breaks. We are buying a put position, 2 SPY 378 puts 07/10 at $5.7 for which the stop loss is at 50%.

For DIA we are trading the following iron condor: 292/293 to 304/305 DIA 07/10 (25 contracts) for a premium of $925. The stop loss, i.e. the buy-back is at $1690, if the condor breaks. We are also buying 2 DIA 07/10 304 puts for $4.42. Stop loss is at 50%.

Both put positions were again 100%+ gainers, and were sold on Friday. SPY puts were sold at $12 for a profit of $1248, DIA puts were sold at $9 for a profit of $904.

The condors failed this time as Friday’s price action (following the jobs report) was too much and we broke the lower boundaries. Unfortunately, the puts were sold before that so we failed to offset the condor losses even more, but the week still ended with a +$818 in the options portfolio.

Our overall return is again at all time high at +299% since we started this competition, and +90% in 2022.

The S&P is -22% in 2022, and -13% since we started the competition.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!

Hi. I have a questions regarding the stop loss that you need to set for the iron condor. (buy-backs) that need to be set for each of the option spreads (bull put and bear call spreads).

1. In your explanation video on youtube, you said to wait until friday to set these, as there can be lots of volatility between wednesday and friday. Is this still the case? Doesnt this increase the risk of the trade quite a lot?

2. How do you set separate stop-losses for the bull put and bear call spreads? Usually if you sell an iron condor you set the stop loss for the entire strategy right? Should we now be selling the bull put and bear call spreads seperately?

Sorry for the rookie questions!