Quick summary:

New survey is up & running - click here.

Last week was cut short by a day and a half due to Thanksgiving

We had good precision on 3 of our indicators, but got the direction wrong

We realized full premium on the SPY condor, lost on the puts

Portfolio was down 0.5% last week, up 160% overall

The Q4 competition is now open for its ninth week. Two more weeks to go before we announce the Q4 winners! Our first 10 users get awarded a prize, the total pot being $5000. The leaderboard is updated and available within the app. Jump in:

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance and portfolio update

Last week was shorter for a day and a half as markets were closed for Thanksgiving Thursday and open only for half a day on Black Friday. This translated into lower volumes traded and no big moves of our main indices, all of which finished roughly where they were when we opened the positions. Slightly higher, though, but still well within our 5% triggers.

Thus, the portfolio long-short positions (only SPY and DIA, no UVXY this time, as the VIX was projected to stay the same) came back at a minimum loss (-0.1% and -0.3%). Similar to the macro positions - the SPY 1.6% loss was partially offset by the call gains (also small), while the QQQ positions went down in both the main allocation and its OTM hedge. That’s what typically happens in low volume environments.

A good play in such environments is the iron condor, which delivered on its premium for SPY. The DIA condor wasn’t played as its risk reward profile was too high (read more on this below). The puts reached their readjusted stop-losses on Friday and ate up all the SPY condor gains.

So overall, our losses were very small, only $250 or 0.48% of the portfolio. Given that we made wrong directional predictions, I would consider this a good week in terms of performance.

Controlling the drawdowns is key, especially during periods of high uncertainty with the markets scrambling to find direction. The week before was equally uncertain and yet we managed to make 2%. Last week, a 0.5% loss. When you’re up 160% for the year, protecting those great returns is crucial. Read more on our past performance and strategies here.

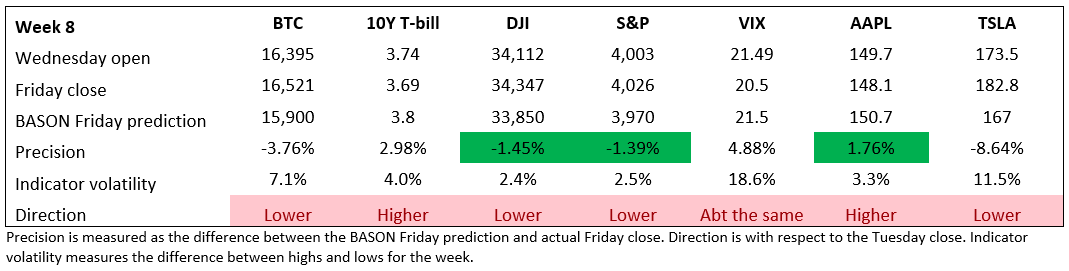

In terms of precision, 1.5% errors for SPX and DIA, quite good. Direction was a miss across the board. This type of an all-out directional miss happened three times this quarter - in week 4, week 6, and week 8.

At first thought this might be concerning, however, the impact on the portfolio each time was negligent. We lost 2.3% in week 4, 3.7% in week 6, and 0.5% in week 8.

In just one good week, in week 5, we made 7.4% - more than we lost in all these bad weeks combined. This is the power of positive skew!

Options: full gains on the condor, loss on puts

As mentioned next week, we opened the following options positions:

...this week we are trading 393/394 to 404/405 SPY 25/11 iron condor (40 contracts) for $1,280 total premium. We are buying 3 SPY 404 puts 25/11 for $4.12. Stop loss was at $1.5, and has been lifted to $1.8 by the end of trading tomorrow.

No iron condors for DIA, the risk-reward premium is too low. We are also buying 4 DIA 25/11 345 puts for $3.65. Stop loss was at $1.5, and has been lifted to $2.5.

The risk-reward was off for the DIA, meaning that we would be risking over $2600 to gain only about $400, which was not a risk payoff that we like. So even though we would have pocketed that premium, we’re happy with our decision not to engage in that trade.

The SPY condor had a better risk-reward payoff, so we took it and it delivered. Unfortunately, all of its premium was eaten up by the losses from the SPY and DIA put. As we told you already on Thursday, we increased our stop-losses on the puts by the end of the trading day. SPY was initially set lower, only to be raised later. Why? Cause the market was trading against us during that Wednesday, and we only had half a day left, so we took a bit of a higher risk there. It didn’t pay off. No big deal, the losses were contained.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!