Results: great precision, decent performance

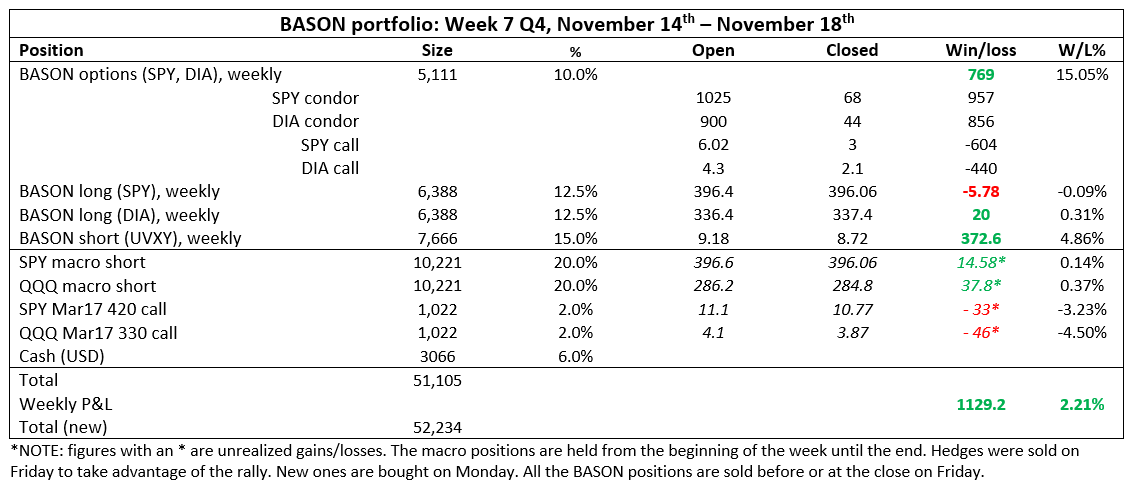

Portfolio up 2.2% for the week, 161% overall

Quick summary:

New survey is up & running - click here.

Last week was not nearly as turbulent as the two that preceded it, but it still delivered some decent volatility

We had excellent precision on 5 of our indicators (1% error)

We realized full premiums on the condors, did good on the VIX, and got stopped out of calls

Portfolio was up 2.2% last week, 161% overall

NOTE: Thanksgiving is this week in the US, so markets are closed Thursday, and open for half-day on Friday

Welcome back, dear subscribers, and happy Thanksgiving to all our US followers!

The Q4 competition is now open for its eight week. The leaderboard is updated and available within the app. Remember, Q4 opened with a new competition and a $5,000 prize pot allocated to the first 10 users. It’s a whole new ballgame and we welcome your great contributions:

NOTE: Keep in mind that markets are closed on Thursday due to Thanksgiving and open only for half-day on Friday.

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance and portfolio update

Last week carried less surprises than the two weeks preceding it (the FOMC and CPI weeks), but it still had a decent amount of volatility. After the highs on Mon and Tue, Wed and Thu finished lower, only to recover sightly by Fri (as per our prediction). The Friday recovery, however, was not as strong as we’ve anticipated but we ended up very close to our price targets, making it a profitable week in terms of portfolio performance.

Our precision was really good on 5 out of 7 indicators (see below), so we got to keep the full premium on the condors. However, the directional move wasn’t great, so we lost money on our SPY and DIA calls, stopped out already on Thursday. In terms of the long/short positions, the VIX had a decent return, whereas the rest basically stayed the same.

In these conditions, in a lackluster market scrambling to find direction, a 2% weekly increase was a good return.

Overall, since May 2021, we are now up by 161%. Read more on our past performance and strategies here.

In terms of precision, notice the errors on SPX, DJI, the VIX, the 10Y, and AAPL. The S&P directional target was off, but came in close on Friday (and was actually right at our target before open in the futures market). However, the slight directional miss didn’t matter given the precision.

This is why we often emphasize our two options strategies; one for direction and one for precision. When we get direction wrong, but precision right, we can still make a decent return. Smaller than when both are right, but around 1-2% surely. Same for when we get direction right and precision wrong - then our call/put positions drive the performance. The only time we lose money on a weekly basis is when we get both wrong. It happens, but when it does, the drawdown is limited (as you have witnessed over the past few months).

This week there is Thanksgiving in the US, so our positions in the market are shorter. We buy on Wed and only have one and a half trading day in front. Let’s see how it goes.

Options: full gains on the condors, loss on calls

As mentioned last week, we opened the following options positions:

As per our predictions, this week we are trading 391/392 to 404/405 SPY 18/11 iron condor (25 contracts) for $1025 total premium. We are buying 2 SPY 392 calls 18/11 for $6.02. Stop losses at 50%.

For DIA we we are trading the following iron condor: 332/333 to 341/342 DIA 18/11 (25 contracts). Total premium is $900. We are also buying 2 DIA 18/11 333 calls for $4.3. Stop loss is at 50% for both.

Calls unfortunately got stopped out on Thursday after the open. They recovered a lot of those losses by Friday btw, but we were out unfortunately. However, the condors delivered. Our 0.8% precision for S&P and 0.46% precision for DJI helped us pocket the full premium on both, $957 on SPY and $856 on DIA, more than enough to offset the call losses.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!