The competition is officially open for week 3/10. Get in, have your say on our 5 indicators and 4 stocks, and keep pushing for that $1000 prize!

Last week our BASON predictions were back to their very best for our two main indicators, the S&P500 and the Dow. Precision was 0.13% for the S&P500 and 0.36% for the Dow!

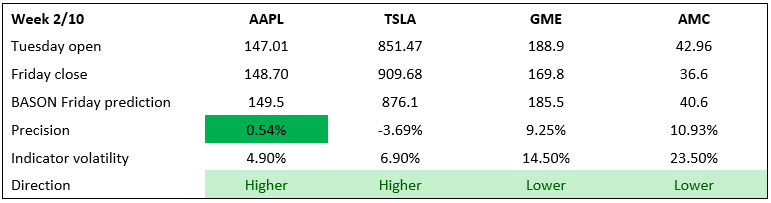

As usual, the weekly volatility was higher than our precision for every single indicator and every stock (see tables below). And although the directional moves for BTC, the 10-year bond yield and oil prices were off, the directions for all four stocks were called correctly, with AAPL ending up at 0.54% precision for the week. However, the meme stocks went down by the end of the week more than anticipated, while TSLA shot up more as well (continuing into this week). Grabbing some TSLA calls last Wednesday would have been a very profitable strategy.

What about collected profits? Last Thursday evening we told you what we were buying:

…we bought two SPY $446 calls with 22/10 expiry date (using the lower boundary of the C.I. for the strike price), and we used an iron condor for the SPY 22/10, at 450/451 to 459/460 (a slightly narrow margin, where we profit if it ends in this interval). We sold 10 contracts here.

Our call is likely to give us between $400 and $1000 profit, and our iron condor gave us $400 when we sold it, so if it expires outside our C.I.s, we stand to lose in total $600. Even if SPY ends up above 459, we will still hold a profitable position. Hedged!

Both strategies were in the money. The iron condor was let to expire and made us the initial $400, while the SPY call ended up giving us a $420 profit before we sold on Friday. Congrats to anyone who profited from the same strategy!

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday morning). Leaving your email is the only way for us to contact you. If you want it, ofc.

So jump in before it’s too late, and beat everyone else!

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!