Welcome back! The competition is officially open for week 8/10 (three more weeks to go!). Get in, have your say on our 5 indicators and 4 stocks, and keep pushing for that $1000 prize, just in time for Christmas! The leaderboard is updated within the app, check to see where you’re at (disregard Oraclum being first, we can’t win the prize obviously :)

You win some, you lose some! Our first week when the markets went against our predictions (at least for the Dow and the S&P, the stock predictions were quite good actually), which also makes it our first week of losing on both SPY strategies.

What happened? Everything was going fine by Wednesday close. All 5 indicators were moving very close to our predictions. Thursday was off due to Thanksgiving and given that Friday was closing at 1pm, we estimated the markets won’t move too much on low-volatility Friday. But to our surprise, something happened in the mean time - the Omicron COVID variant, and it sent the markets to a high volatility sell-off on Friday.

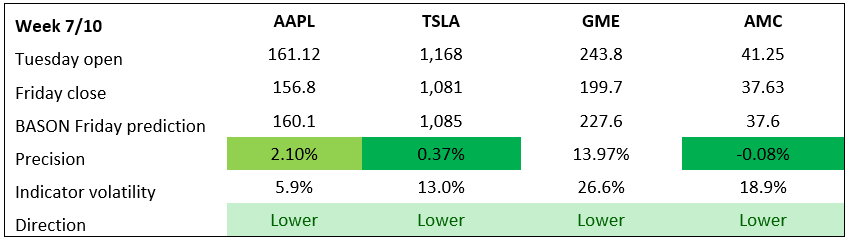

It wasn’t actually all that bad in terms of precision; most indicators were around 2% margin of error (BTC, TSLA, and AMC were even better), but the direction was the main issue this time. The missed direction accounted for the losses on our SPY options strategies (more on that below). But the stock predictions were both very precise and in the right direction for all four stocks. Even without Friday’s sell-off the stock predictions would have been in the right direction (but probably less precise for TSLA and AMC).

Believe it or not, this unexpected sell-off was exactly what we needed for the BASON. It would have been impossible for our users to predict an outside-the-market event that would trigger such a reaction on what was expected to be a pretty dull end of week. When it happened, it pushed our index predictions outside their intervals and in the wrong direction for the first time ever.

This is why we’re doing these predictions with our own skin in the game over a longer period of time (it will be a year and a half in total). Because ultimately we need to see how many weeks the BASON will be profitable, and how many weeks it would carry a loss, but most importantly we need to successfully protect ourselves (and anyone following our strategies) from downside exposure.

Last week we said:

We bought SPY 26/11 at 464/465 to 472/473, selling 10 contracts for an immediate $400 gain, which we will keep once the contracts expire within the interval.

Due to an expected rebound, we bought two SPY 26/11 calls at 462 strike when SPY was at 466 yesterday morning. As usual, we stand to get between $400 and $1000 if we stay within the interval.

The iron condor’s lower boundary was broken. The maximum loss here was $600, but during Friday we triggered our stop loss at $400.

Similar for the two calls, which were bought for $1100, but sold at a loss of $550 on Friday morning. In total therefore, last week we lost $950. A negative 86% return for the week (and 5% overall).

However, letting them run till expiry would have implied a $1700 loss, so in those terms we did well to protect our downside exposure. In total we are still up overall, earning $5100 in total over the past 7 weeks (down from $6050 last week), and $7,975 since the start of this survey in the summer (79% return).

From the first 12 weeks, we had one losing week, and from the current 7 weeks, also only one losing week. Two bad weeks out of 19, which would make it 5 to 6 losing weeks during the entire year. Not bad at all.

The most important take-away: the BASON is likely to produce a loss only when something unexpected happens by the end of the week, but this loss will always be limited, protecting our downside. >90% of the time the BASON will be profitable, and the profits will more than offset the occasional losses.

We are happy to further test and prove this hypothesis throughout 2022 as well (especially after the Fed starts raising rates).

Join the competition!

Participate in our survey competition regularly to get our predictions before others get it, and try to make some profits from it.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday morning). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!