Quick summary:

New survey (on our new app) is up & running - click here.

So is our new podcast where we discuss what went down last week and what we’re looking at in the weeks to come

Coming up this week: big retail earnings (Wallmart, Home Depot, Target), FOMC minutes released on Wednesday, inflation and GDP numbers from Europe and Japan

The survey is live on our new app, jump right in:

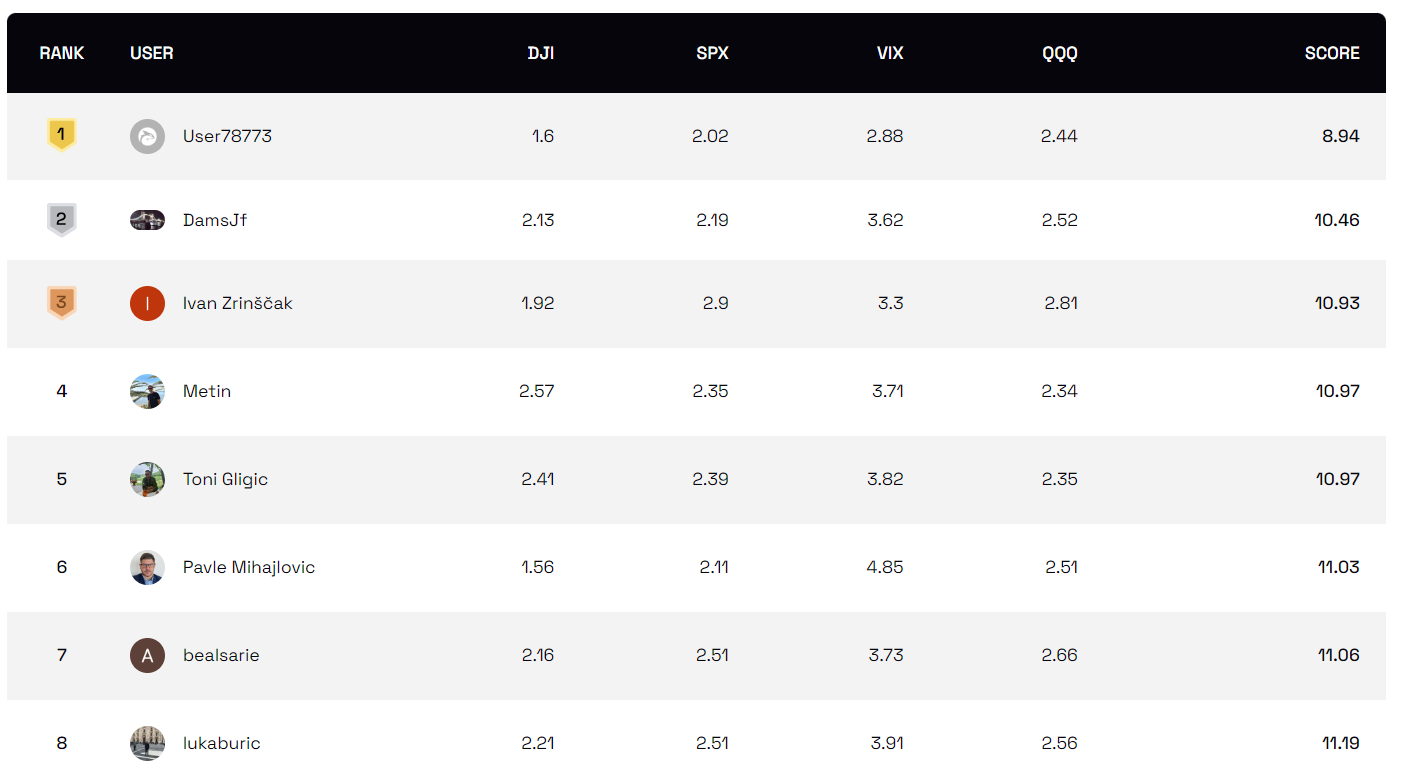

Also a reminder to everyone who has yet to join in the survey. The competition at the top is intense: 0.33 points between the #2 and #8. The leader is drifting apart, but the rest are tight. Well done everyone!

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Podcast episode #3: The Burry Big Short vol 2?

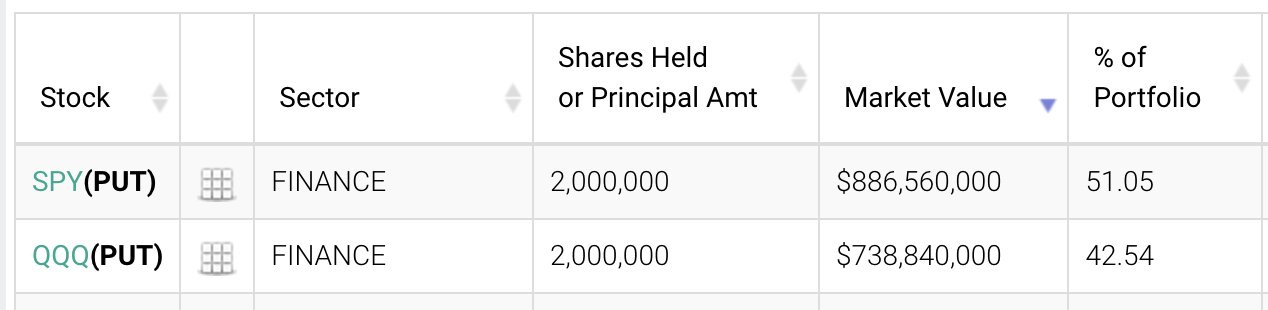

Apparently the big news yesterday was that famous investor Michael Burry (of the Big Short fame - played by Christian Bale) went $1.6bn short SPY and QQQ with 93% of his portfolio.

Except, he didn’t.

Not $1.6bn, and definitely NOT 93% of his portfolio. That would be insane, to place your entire portfolio on (apparently, a few months to expiry OTM) puts. Only with perfect foresight can you even start to think about doing something like that.

First of all, that was from his 13F report from June 30th, meaning that by now he could have already sold the position. We have no clue.

Second, if he bought back in June, markets are still higher than they were back then. SPY was trading between 424 and 443 in June, while QQQs were trading between 348 and 372 in June. So unless he bought at the top, at 443 for SPY and 372 for QQQ, the position is still at a loss for both. Given theta decay on OTM options, almost certainly (again, unsure as to when they expire). A 10% OTM put bought in June was around a 400 or lower strike price put position. We are still long way to go from it being in the money, and the August sell-off wasn’t that sharp to reprice to option so swiftly.

Third, much more importantly, the 13F shows notional value of options, not the market value. Notional value is calculated as number of contracts times 100 times price of underlying. Unpacking this, he most likely bought about 40,000 put contracts, worth about $40m in total, or about 2-3% of his portfolio - just the perfect amount for a hedge.

So what he really did was buy some hedges back in June (probably, could have been May or April as well).

Avid readers of this blog will recall that we also suggested buying relatively cheap hedges, both at the end of June and mid-July. Our hedges are doing quite nicely since then, having prevented losses during the August sell-off (which is their point).

As for markets, still no sign of breaking the weekly bear trend. Lower lows, lower highs. As we mentioned last time, an orderly sell-off (as opposed to a sharp one) is gaining probability. Hold on to those hedges.

Watch out for Wednesday’s FOMC minutes and retail earnings coming up this week.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!

Share this post