Overview of 2024 predictions

Evaluating how we did on market timing

Given this was a shorter week, we wanted to take the opportunity to look back at some of our predictions throughout this year. As you know, we use this newsletter to communicate our macro views and which market regime we believe we are in, to better understand the long-term dynamic that moves markets. We share these with our paid subscribers as we believe they do provide excellent value for long-term investors (not short-term traders) who want to know how to optimally position for different market environments.

On a weekly level, however, we do trade short-term, and we do it by only listening to the BASON. It delivers consistently excellent benchmark-beating performance, with low volatility, and low correlation to the S&P500. Whenever you get tired of trading markets by yourself, feel free to reach out and try the BASON for a while:

In the next three weekends we will present the bull 🐂 view, the bear 🐻 view, and our view 🦈 for 2025, after which we will wrap it up for the year with the final overview of the ORCA BASON Fund performance on Dec 28th, just like we did last year.

We begin our overview with the review of our annual predictions for 2024, made back in December 2023. But first, let’s see what happened to markets in 2024.

Overview of the market in 2024

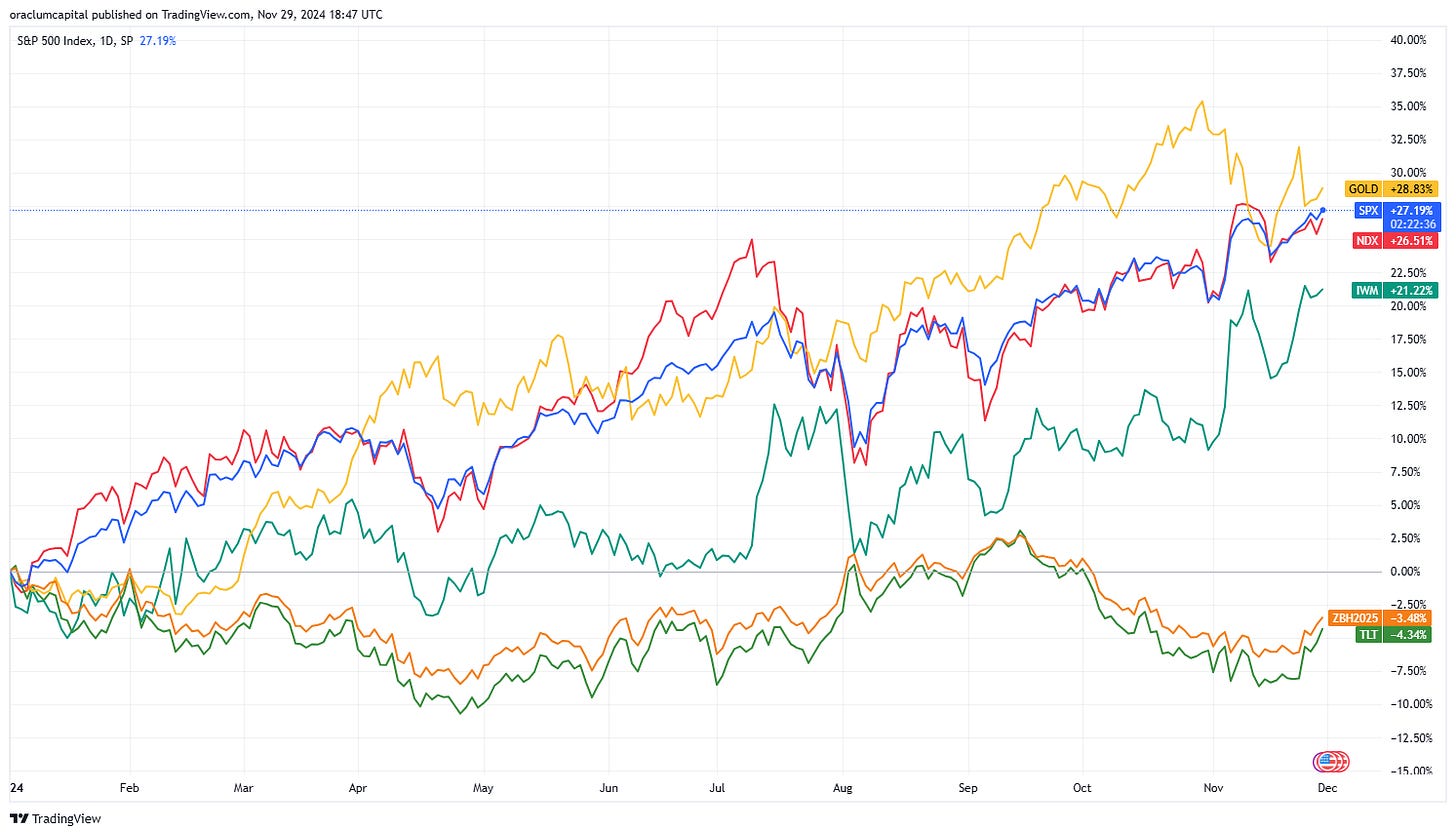

SPX opened this year at 4,770. It will close probably over 6,000 (currently at 6,040, a 27% growth!). Almost no one was that bullish coming into the year. Among the Wall Street analysis, 5000 was the bull view (!), between 4,600 and 4,700 was the consensus, while bears wanted it to go back down to 4,200. What a miss!

As for other assets, NDX was similarly impressive (26%), but Gold outperformed both (at 28.8%, becoming once again the main inflation hedge). And once again, for the fourth year in a row, bonds sold off and ended up negative, as did oil (not shown, but is thus far negative for the year, driving the disinflationary momentum all year round).

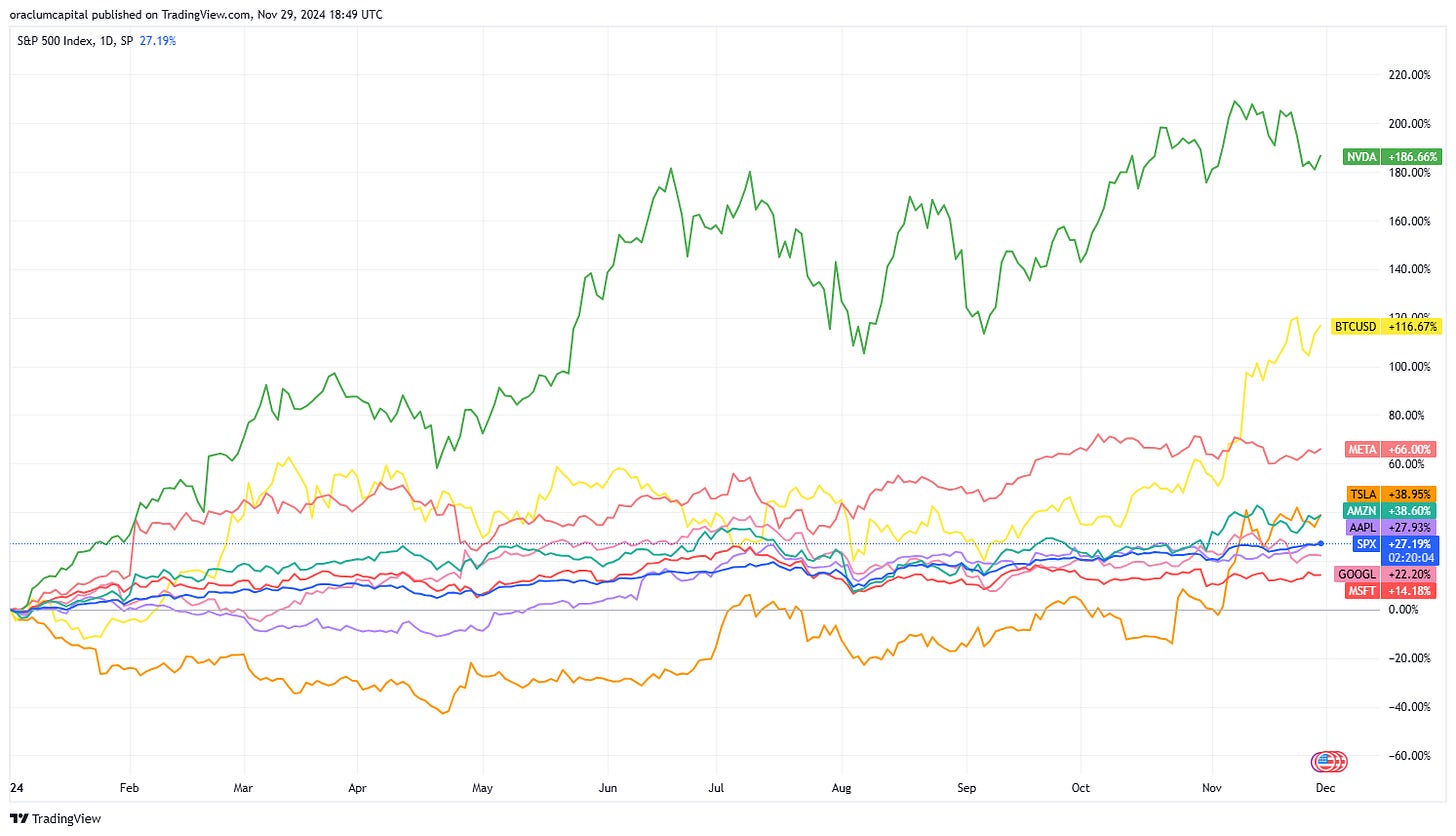

It was another great year for Mag7, although the standout performer was by far NVDA. A whopping 187% growth, outperforming even BTC with its post-election surge to $100,000 (currently at 116% annual growth). From the Mag7, only GOOGL and MSFT underperformed (interestingly, the AI trade failed to work for them this year, but it almost tripled NVDA), while TSLA was negative most of the year, only to see a huge surge following Trump’s victory (the Musk trade, clearly).

All in all, still a very strong and also highly skewed bull market, driven by a handful of tech stocks. How long can this last? The million dollar question! We’ll try to answer this over the coming month.

Our general view and performance in Q1

Our view coming into 2024 was careful, however given the monetary and fiscal easing we got in Nov and Dec 2023, we acknowledged that we are coming into a soft landing, abandoning the usual macro reality of high rates:

With both fiscal and monetary policy being so accommodative, it really is looking more like a soft landing.

Our baseline view is that we first and foremost trust the macro logic. That makes us more bearish (read: careful) in general, but given that we are also very pragmatic, we are happy to hold long positions until we see a strong enough catalyst to trigger a bearish sentiment and a move down. The first obstacle is coming up mid to end of January. Then we will reassess. For now, it’s just buy and hold. And wait.

Even the direct trade implication was to hold on to the bond and equity longs coming into January:

Santa rally and the January effect don’t happen every year, obviously. But given the conditions and the context under which this year is ending, the probability for each is high.

We are therefore holding on to our equity (SPY, QQQ) and bond (TLT) longs for now. At the very least until the options expiration in mid-January (17th to 19th). The probability of a sell-off before then is relatively low. It’s always possible, obviously, but we are comfortable enough with our profits not to engage in any hedges for now. As soon as we change our mind, we will write about it.

This was spot on, as the catalyst to the downside never materialized. This became obvious already in early February. In hindsight this was the key newsletter: “If you can’t beat them, join em”. After a failed attempt for a sell-off after QRA and FOMC, the long bias became the main play for the year. While still acknowledging a correction might happen, the prevailing positioning was bullish.

We did a detailed overview of the month-by-month calls on the newsletter back in March. During the rest of Q1 we remained quite bullish, stressing out the several occasions when the markets could have sold off, but each moment was just another buy-the-dip opportunity, exhibit below:

The Q2 correction and bounce-back

The correction came in April. On April 6th we warned of a technical indicator breaking through a longer trend set up in the first three months, and the sell-off soon ensued. In that same newsletter (it was a good one, discussing the probability of a no landing and the QT) we also warned about the April seasonality. To be fair, the week before we stated that the Fed was committed to growth, and that the bias for the rest of the year will remain bullish.

On May 1st, after FOMC, the conclusion was clear:

In other words, I expect the 2024 trends to continue - equities pushing up, bonds selling, and bond yields pushing up.

This was echoed already two weeks before in the middle of the April sell-off:

we are still seeing more bullish long-term conditions. Thus far, the economic data has been supportive of strong company earnings, and these should continue to deliver. Remember who the driver of the rally is - the Mag7 (or better yet Mag6, minus TSLA this year). The EPS revisions for Mag7 have been remarkable thus far.

And during the entire time of the market selling off, and especially before and during the summer, we kept reminding our readers that earnings and technicals are bullish, and that election-year seasonality is likely to result in a bullish view for the rest of the year:

“June-August is the second strongest 3-month period of the year for all years going back to 1928 with the SPX up 65% of the time on an average return of 3.2%. In Presidential election years, the SPX is up 75% of the time from June-August on an average return of 7.3%.”

Summer: bouncing up and down

Then came what was supposed to be a peaceful summer, a gradual grind up. It was anything but! This is where we failed to fully anticipate the sell, but we did provide this warning amidst the July window of weakness:

To sum up, I do expect a mean reversion next week, but if earnings of GOOGL (and TSLA) disappoint, or get punished anyway, then brace yourself for an April-like sell off.

And then again just before the August 5th sell-off, admitting that our Fed view from the week before was WRONG:

markets are pricing in a recession, and very quickly. This most likely means the sell-off will continue. If you haven’t hedged already, do so before it’s too late. In a nutshell, the Wed conclusion was WRONG.

We are in between the final two scenarios mentioned last week, leaning towards this one: Poor Mag4 earnings, Fed not dovish, Treasury increases coupons - sell off continues, we get a repeat of last summer.

Market price action quickly invalidated the bearish call however. On Aug 13 and 17 we were already back to the bullish view, and further vindicated this view after Jackson Hole on Aug 24. This is when Powell made the “time has come to cut interest rates” speech and it was safe to say this was priced in as a bullish signal for the rest of the year:

monetary policy is now clearly accommodative and supportive of an end-of-year rally.

End of year run-in

We told you to keep it cool in September, despite the early month selling, and then went with a strong long bias after the cutting cycle began on Sep 18, with the following conclusion on Sep 21:

Just keep looking at the macro conditions. The labor market, GDP growth estimates, and still do keep an eye on inflation in the next 6 months if the cuts start heating up economic activity too much.

In light of these expectations, the best positioning would be to buy long-dated SPX (or SPY) calls (March or even June expiry). These are selling close to $30 (570 SPY) for March and $37 (570 SPY) for June, and close to $300 and $380 for SPX in March and June respectively (a call spread is not a bad idea here either).

=> You know how much the March SPY calls are selling for now? They closed yesterday at $48. That’s a 60% upside on that trade, and the trade is still not over in my opinion. Not until January.

And finally, as we were looking ahead of the US elections, recall what our main point was, that we kept repeating week after week:

Remember, vol is expensive coming into the event, and as the event passes, there is likely to be an unclench of volatility, which can often result in a strong post-event rally (VIX down, SPX up). The scenarios discussed above are more long-term outcomes (end of year and 2025 in particular). The day-after effect could in each case be a rally.

The SPX rallied as a consequence of both the vol unclench that would happen either way, but also due to a Trump victory which was obvious given the reactions in small caps, tech (especially TSLA), banks, and the US dollar, while bonds sold off. Once again, exactly the scenario we had discussed in our election playbook special:

The first scenario is still the most viable outcome following the Red Sweep, it will just take a while to see how the Fed will react during 2025. Inflation might be the talk of the town once again. More on this in the next three weeks.

Verdict

Overall, the careful view with which we came into this year was quickly overturned into a strong bullish outlook, hammered through several times this year.

In Q1 the bearish stance was invalidated, and hedges were ineffective. Buy-the-dip was strong. During the April sell-off some hedges did perform well, but coming into May, a strong bullish view amidst a seasonally good election year made sure the ride was smooth.

At least until August where some caution was called for, but also very quickly invalidated (very similar to March 2023). By the end of August and September, Powell gave markets all the reason to be joyful, which was confirmed once again after the elections. We are now riding the wave into yet another all-time-high, and SPX could very well end the year at 6,200 (a 30% upside!). We made this point again two weeks ago, in our medium and long-term views. The flows are likely to be supportive towards the end of the year.

So overall, a few bad calls back in February and July, but mostly kept riding the bullish soft-landing narrative as it was hard to be bearish this year. Despite a few slip-ups, the market never gave the bears a chance.

Stick with us in December as we will deliver our view for 2025, as well as the consensus bullish and bearish views.

Thanks for reading and thanks for being a subscriber!

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.